Automakers brace for higher costs as steel and aluminum tariffs kick in

Automakers are still dealing with whiplash from the delay, imposition and then partial rollback of tariffs on Canada and Mexico. And starting today, they also face higher tariffs on steel and aluminum — raw materials that the auto industry consumes in vast quantities.

President Trump imposed tariffs on the two metals during his first administration. But now he’s expanding them. This time, the 25% tariff on steel applies without exceptions for any countries or industries that rely on the metal, and the tariff on aluminum is rising from 10% to 25%. Trump said in a proclamation that the tariffs are justified on national security grounds, although he has also said in remarks they will promote U.S. jobs and make U.S. companies more profitable.

The move was celebrated by domestic steel producers (though aluminum producers and steelworkers warned it was counterproductive to put tariffs on Canada). But it adds another pain point for car manufacturers and other industries that rely on those metals.

The expanded tariffs on steel and aluminum “place U.S. manufacturers at a tremendous disadvantage—including those who do not import these raw materials,” the Coalition of American Metal Manufacturers and Users said in a statement. The coalition represents suppliers that use metals as an input, making wires, tools, machines and parts for cars, construction, consumer goods, electronics and other industries. “The reality is that the U.S. does not produce enough steel or aluminum to meet domestic demand, and new production facilities cannot be built instantly.”

Ford CEO Jim Farley told investors last week that even though Ford gets most of its metal from within the U.S., it will still feel the effects of the tariffs. “Our suppliers have international sources for aluminum and steel. So that price will come through,” he said. “We’ll have to deal with it.”

Ann-Marie Uetz, a trial attorney who often represents auto suppliers, said in a recent webinar that even if automakers don’t want to share those costs, they often have no choice. “The [automakers] can’t afford for all their suppliers to go out of business,” she said.

The first time Trump imposed tariffs on steel and aluminum, he proceeded to negotiate a number of exemptions. That doesn’t seem to be an option this time around, Iacob Koch-Weser, an analyst at Boston Consulting Group, observed in a note. “The main options are to source domestically or pay more for imported materials,” he wrote. Either way, costs will go up.

Meanwhile, Trump’s tariffs on Canada and Mexico are in place, but have been suspended until early April for most — but not all — cars and car parts. If those tariffs are reimposed for a significant period of time, it could further drive automaking costs up further — even in the U.S. That’s because the North American supply chain is highly integrated, and auto parts may cross the U.S. border several times.

And there are yet more tariffs coming, with Trump set to make announcements on April 2 about tariffs on other countries and specific goods — possibly including cars.

Jamie Barsimantov, with the supply chain risk management company Sphera, says there’s not much that companies can do right now to prepare for those yet-to-be-announced tariffs.

“If they know what’s going to happen, then they can adjust,” he says. “But if they don’t know what’s going to happen, then they kind of just sit there and wait. And that just means prices go up if the tariffs do come into effect, because they’re not really going to be able to make changes to adapt to them in the short term.”

Meanwhile, Trump has publicly said that he is “saving our auto workers and companies from economic destruction” by rolling back regulations, including vehicle emissions standards that are pushing companies to make more electric vehicles. For automakers, what the industry needs is more complicated than a total rollback. They want consistency, and worry about ceding the global EV market to China, even as they object to some rules.

And even if deregulation would be welcome, for now, it’s not what companies are thinking about, Uetz said. “The suppliers I am talking to right now are so hyper-focused on tariffs and trade,” she said. “They’re absolutely hyper-focused on these costs right now, until they get some certainty.”

Inflation cools slightly in November as worries about affordability grip Americans

The cost of living in November was up 2.7% from a year ago, according to a report Thursday from the Labor Department. That's a smaller annual increase than for the 12 months ending in September.

New York has a new Archbishop. His background looks a lot like Pope Leo’s

Like Pope Leo, Bishop Ronald Hicks is an Illinois native with deep experience in Latin America.

Could international troops be sent to Gaza? Here’s why Trump’s plan hinges on it

President Trump's peace plan for Gaza hinges on international troops in Gaza, but Israel is skeptical and no country has yet agreed to send their soldiers.

RFK Jr. and Dr. Oz to announce moves to ban gender-affirming care for young people

Health Secretary Robert F. Kennedy Jr. is expected to announce a package of measures that would together ban gender-affirming care for minors. A press conference is set for 11 a.m. Thursday.

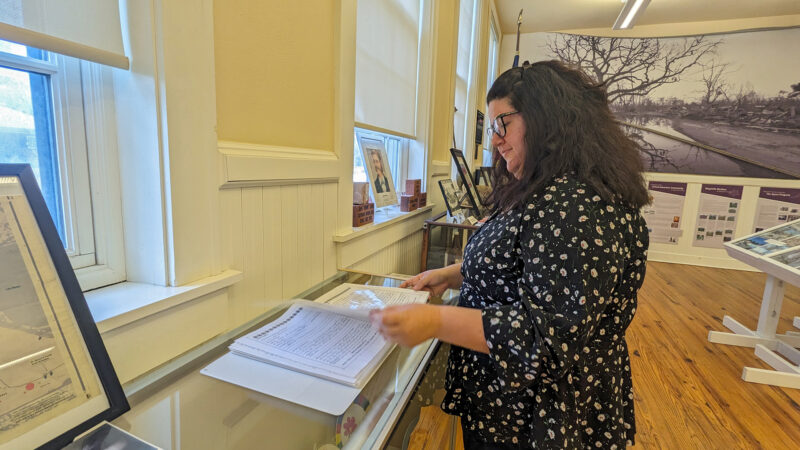

20 years later, Waveland’s letters to Santa tell stories of recovery from Hurricane Katrina

More than a thousand letters were written and answered after the hurricane. They’re now housed in an exhibit at the Ground Zero Hurricane Katrina Museum.

A new ‘Avatar,’ a marital stand-up story and a gut-wrenching drama are in theaters

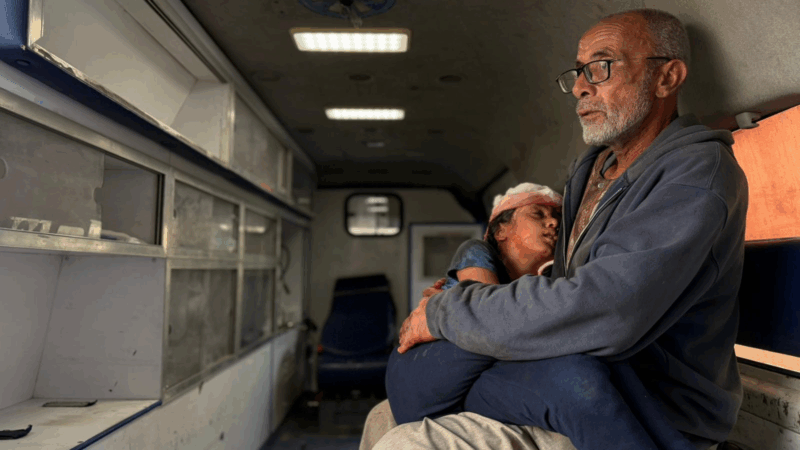

A new drama uses the real, gut-wrenching recordings of a call for help from Gaza to tell a harrowing and profound story.