Automakers are eating the cost of tariffs — for now

Tariffs have been costly for the auto industry. Higher taxes on imports like aluminum and steel are pushing up the prices of the materials that go into cars, while tariffs on foreign-made parts and imported vehicles have been as high as 25% since the spring. Even after recent deals struck with Japan and the European Union, tariffs on imports from those countries are still at 15% — far higher than in previous years.

But so far, those costs have not been passed along to consumers.

Data from Kelley Blue Book shows that new vehicle transaction prices — the amount that buyers actually pay — were up 1.2% year-over-year in June. That’s actually a smaller price increase than the 10-year-average increase, meaning that as tariffs kicked in, car prices rose less than they typically do.

“It’s been a little bit surprising, but good for the consumer,” says Erin Keating, executive analyst for Cox Automotive, the parent company of Kelley Blue Book.

Part of the reason is that when tariffs took effect this spring, dealer lots were full of vehicles that had already been imported tariff-free.

Keating says another factor is that as people rushed to buy cars ahead of tariffs, companies seized the moment as a chance to attract new buyers to their brands. By putting off price increases, they could capture more sales.

Also, carmakers had good reason to worry that if prices rose, shoppers would simply stop buying. “Consumers are already stretched thin,” says Ivan Drury, the director of insights at the auto data company Edmunds.

The average price of a new car is nearly $50,000 — and even used cars are nearly $30,000 on average. A record number of new car buyers are paying more than $1,000 a month on their loans, and a growing share of car owners owe more on their car than it’s worth. Interest rates and high insurance costs — which are also exacerbated by tariffs — are causing pain, too. At some point, a new car is simply too expensive.

“So really, price is almost the last thing [automakers] are touching” to deal with tariffs, Drury says.

Instead, so far, big automakers have been absorbing the loss.

In calls with investors, automakers have been laying out their tariff bills for the last three months: $1.1 billion for General Motors, $600 million for Hyundai, more than $500 million for Kia, $1.5 billion for Volkswagen. Stellantis, the parent company of Chrysler, Dodge, Jeep and Ram, expects their total tariffs for the year to be around $1.7 billion.

“For a majority of the automakers, they’re really taking the tariffs on the chin,” Keating says. Suppliers, too, are taking a beating from the tariffs, she notes.

That punch to the chin is not a knockout blow. GM, Hyundai, Kia and Volkswagen are all still profitable despite their tariff bills. (Stellantis is not, but its woes predate the tariffs.)

Still, the companies are under pressure from investors not to absorb those costs forever.

Some companies are responding by moving more production to the U.S. In Volkswagen Group’s call with investors, CEO Oliver Blume hinted about the possibility of making Audis in the U.S., saying, “we can think about localizing Audi products.” (The company builds Volkswagens in Chattanooga, Tenn., but does not currently make any Audis in the United States.) And GM is moving production of the Chevy Blazer from Mexico to Tennessee.

A second option is to squeeze costs, getting suppliers to take on more of the burden or just finding savings somewhere else in the supply chain.

And eventually, executives have indicated, costs will be passed along to consumers.

“I think we can make progress on pricing,” Stellantis CFO Doug Ostermann said on his company’s call. And when car executives talk to investors, “progress on pricing” means higher prices, not discounts.

Drury and Keating both say that when the 2026 model year vehicles start to arrive on lots in the next few months, it will be a natural time for prices to go up.

“We’ve done some calculations,” Keating says. “We anticipate that pricing would rise 4 to 8%, 8% really being the max, before truly a car is going to price itself out of its competitive set.”

In addition to sticker prices going up, Drury predicts that costs will get passed along to consumers in more subtle ways. A 1.9% financing deal might become a 3.9% rate; $3,500 cash back might become $1,500 cash back.

“You will see something change,” he says.

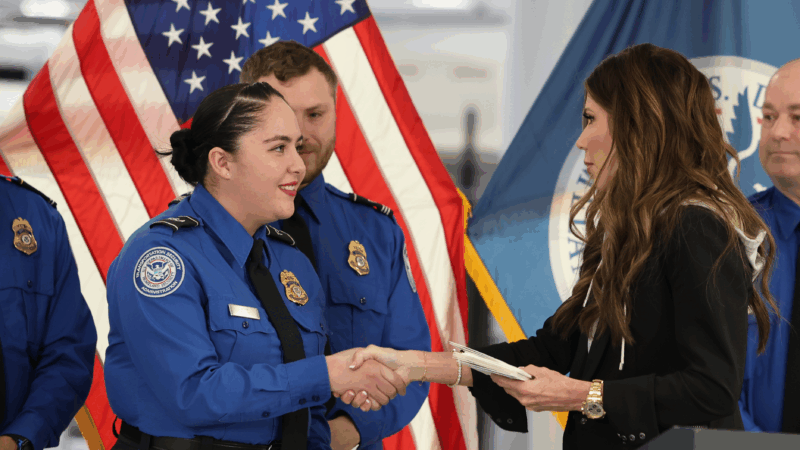

Homeland Security suspends TSA PreCheck and Global Entry airport security programs

The U.S. Department of Homeland Security is suspending the TSA PreCheck and Global Entry airport security programs as a partial government shutdown continues.

FCC calls for more ‘patriotic, pro-America’ programming in runup to 250th anniversary

The "Pledge America Campaign" urges broadcasters to focus on programming that highlights "the historic accomplishments of this great nation from our founding through the Trump Administration today."

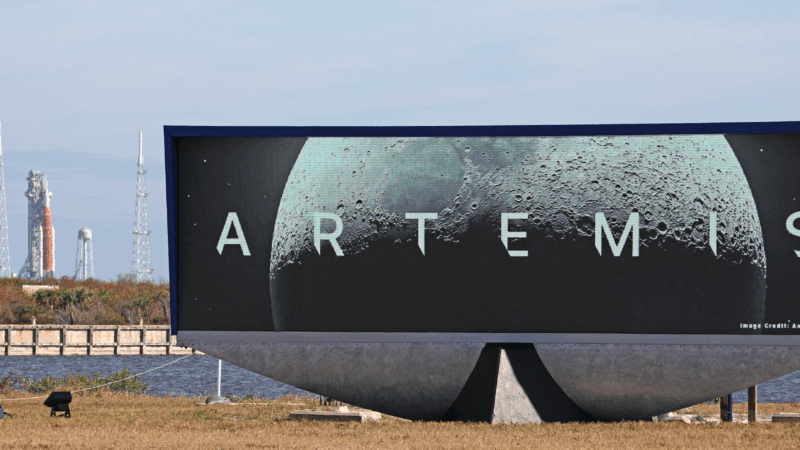

NASA’s Artemis II lunar mission may not launch in March after all

NASA says an "interrupted flow" of helium to the rocket system could require a rollback to the Vehicle Assembly Building. If it happens, NASA says the launch to the moon would be delayed until April.

Mississippi health system shuts down clinics statewide after ransomware attack

The attack was launched on Thursday and prompted hospital officials to close all of its 35 clinics across the state.

Blizzard conditions and high winds forecast for NYC, East coast

The winter storm is expected to bring blizzard conditions and possibly up to 2 feet of snow in New York City.

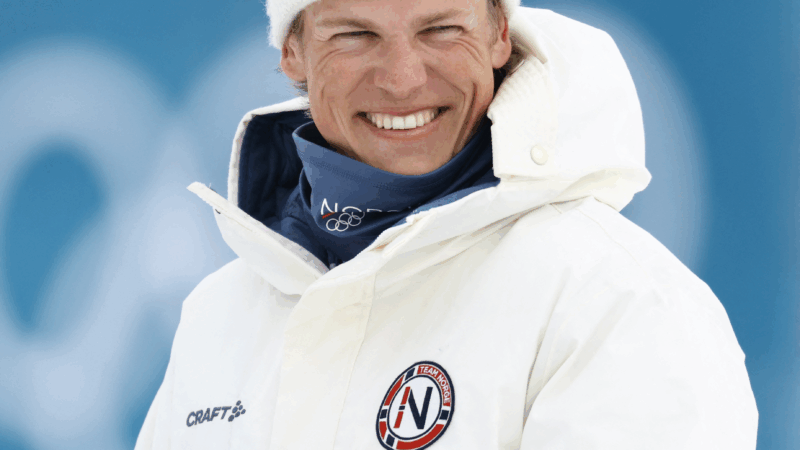

Norway’s Johannes Klæbo is new Winter Olympics king

Johannes Klaebo won all six cross-country skiing events at this year's Winter Olympics, the surpassing Eric Heiden's five golds in 1980.