Auto industry braces for a blow from 25% tariffs on Canada and Mexico

As President Trump’s once-postponed 25% tariffs on Canada and Mexico are poised to transition from a threat to a reality, the auto industry is preparing for higher costs and an extraordinary disruption to their North American supply chains.

“The tariffs are all set,” Trump told reporters on Monday afternoon, saying that there was no room for Canada or Mexico to negotiate another reprieve. “They go into effect tomorrow.”

Trump also says he will double the tariffs he imposed on China last month, from 10% to 20%.

Speaking on Monday, Trump called his announcement “very exciting” for the auto industry and said it would benefit from his tariff plan. “So what they have to do is build their car plants, frankly, and other things in the United States, in which case they have no tariffs,” Trump said.

But the auto industry itself has been vocally opposed to these tariffs. And that’s in large part because car plants in the U.S. rely on parts from Canada and Mexico.

“Let’s be real honest,” Ford CEO Jim Farley told an investor conference in February. “Long term, a 25% tariff across the Mexico and Canadian border will blow a hole in the U.S. industry that we have never seen.”

In fact, Farley noted, because U.S. plants have built supply chains that span North America, U.S.-based manufacturing will be hit especially hard. Analysts at Bernstein Research have similarly found that the Detroit automakers will be particularly vulnerable, compared to their international competitors.

As parts criss-cross borders, tariffs will hike prices

The North American auto supply chain is, to use the industry parlance, “highly integrated.” That means factories in the U.S., Canada and Mexico ship components back and forth. For decades, trade agreements — first NAFTA and then the Trump-negotiated replacement, USMCA — supported this arrangement.

In fact, the same car part can cross a U.S. border multiple times as it travels through the manufacturing process. NPR has previously shown how this happens with bundles of wires, and The Wall Street Journal recently visualized that journey for transmission modules.

So while cars made in the U.S. are not subject to these tariffs, the parts that go into them often are. In February, Patrick Anderson of Anderson Economic Group presented research to the Automotive Press Association breaking down the increase in component costs for specific U.S.-made vehicle models, assuming that companies do their best to manage the costs. He said that the tariffs could boost manufacturing costs by $4,000 to more than $10,000 per car, depending on vehicle model.

Now, companies could try to mitigate these costs by stockpiling parts or relocating some production; carmakers have been assuring their investors for months now that they have contingency plans in place. And to protect sales, they also might absorb some costs, rather than passing them all along to car buyers.

But multiple analysts still anticipate that consumers will see car prices rise; thousands of dollars in additional production costs overnight are just too hard to avoid, even with savvy management. The investment bank Jefferies has predicted prices would go up by about 6% on average, or $2,700, while two analyses cited by Kelley Blue Book agreed on a $3,000 average price bump.

Vehicle prices, of course, are already quite high, averaging about $48,000, which is out of reach for many car shoppers. Although they have recently leveled off, prices remain up significantly from pre-pandemic levels — which, in turn, has put pressure on used car prices.

Other tariffs, and uncertain timelines, complicate planning

Meanwhile, other tariffs — some already scheduled, and some merely proposed — would also upend automaker supply chains. Higher tariffs on steel and aluminum, two key raw materials, kick in this month. Trump has proposed a 25% tariff on imported vehicles from Europe, as well as other country-specific tariffs.

For weeks, automakers had hoped the tariffs on Mexico and Canada would remain threats, not actual policy. Now they’re hoping that the tariffs are short-lived.

And as companies try to navigate these shifting trade policies, one challenge is that the Trump administration’s stated goals for tariffs are often contradictory. A tariff designed as a diplomatic lever might be lifted as soon as a goal is achieved — and the Trump administration has said that tariffs on Canada and Mexico are a response to inadequate border and drug enforcement. But a tariff meant to promote U.S. jobs or raise revenue might be made permanent.

Companies are reluctant to make long-term plans, like building new factories, with so much uncertainty.

Analysts at Jefferies wrote in a note to clients on Monday that “the only thing we know for sure is that we don’t know what Trump will do.” Last month, S&P Global Mobility, an automotive data and intelligence firm, warned that “the uncertainty chaos” around tariffs would delay companies’ decisions about what vehicles to build and where.

And that’s before factoring in the specter of retaliatory tariffs — hikes imposed by other countries in response to U.S. actions.

Gustavo Flores-Macias, a professor of government and public policy at Cornell University who focuses on economic reforms, thinks that’s likely to come next. “While Canada and Mexico have sought to find a diplomatic solution to the White House’s demands regarding undocumented migration and fentanyl trafficking, both countries are likely to retaliate in kind even if they stand more to lose economically,” he said in an emailed statement.

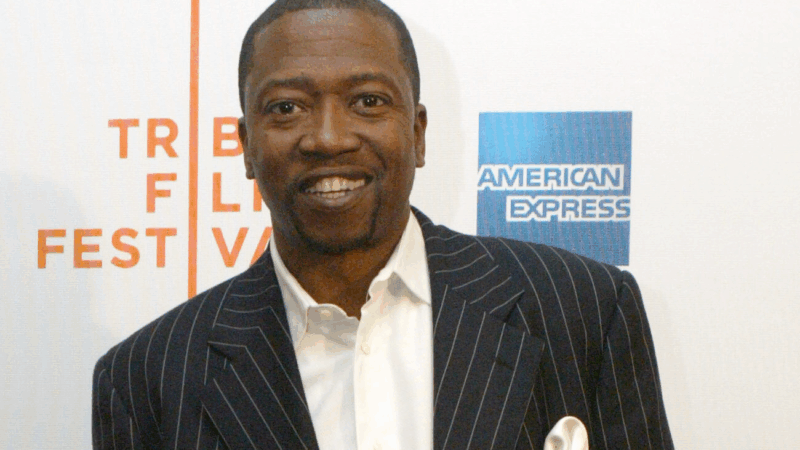

Veteran actor T.K. Carter, known for ‘The Thing’ and ‘Punky Brewster,’ dies at 69

T.K. Carter gained fame as Nauls the cook in John Carpenter's 1982 horror classic, "The Thing."

Who is Reza Pahlavi, the exiled Crown Prince encouraging demonstrations across Iran?

In exile for nearly 50 years, Iran's Crown Prince Reza Pahlavi has issued calls urging Iranians to join protests sweeping the country. But support for him may not be clear cut.

US launches new retaliatory strikes against ISIS in Syria after deadly ambush

The U.S. has launched another round of strikes against the Islamic State in Syria. This follows last month's ambush that killed two U.S. soldiers and an American civilian interpreter.

6 killed in Mississippi shooting rampage, authorities say

The alleged gunman, 24, has been charged with murder after the Friday shootings in northeast Mississippi. The victims include his father, uncle, brother and a 7-year-old relative, authorities said.

Washington National Opera leaves Kennedy Center, joining slew of artist exits

The WNO is just the latest to say they will no longer perform at the Kennedy Center since Trump took over last year.

Ukrainian drones set fire to Russian oil depot after Moscow launches new hypersonic missile

The strike comes a day after Russia bombarded Ukraine with hundreds of drones and dozens of missiles, including a powerful new hypersonic missile that hit western Ukraine.