AI and Nvidia have been bright spots in an uncertain economy, but there are doubts now

The artificial-intelligence bubble has been propping up the stock market and the broader economy for a while now. What happens if it bursts?

That’s been the question circling Wall Street recently, as Big Tech companies face both unprecedented political pressures from the White House — and new doubts about all the money that’s pouring into AI investments.

This past week, AI darling Nvidia reported blockbuster financial results that beat analysts’ expectations. But investors weren’t impressed. Shares in the chip company dipped 4% in the two days since that report.

Nvidia is still the world’s most valuable company, and it alone makes up about 8% of the S&P 500. It and the other so-called “Magnificent Seven” tech companies are contributing both to real economic growth — by investing billions and billions of dollars in developing artificial intelligence — and to the stock markets that Americans rely on for their retirement investments and other savings.

The S&P 500 is up almost 10% and the tech-heavy Nasdaq is up over 11% since the start of the year. That surge comes despite mounting uncertainty over the performance of the wider U.S. economy, the long-term effects of President Trump’s sweeping tariffs, and the increased prices they are widely expected to cause for consumers.

The AI gold rush isn’t paying off yet

For businesses and investors, the promise of artificial intelligence has been a big economic bright spot amid all the other gloom. In this modern-day gold rush, Nvidia and its competitors are selling the picks and shovels: the semiconductors that many tech companies are using to develop AI systems and capabilities.

Those companies, in turn, are selling their AI products to all the non-tech companies that are prospecting for gold — that is, looking for ways that AI can make their operations cheaper or more efficient.

But very few have seen results yet. The vast majority — 95% — of companies that are experimenting with AI aren’t seeing any revenue from it, according to a new survey from MIT. The publication of its findings last week sent the Nasdaq into a days-long slump.

“Most companies are not getting the benefit [of investing in artificial intelligence], but they feel like they have to keep trying because of the magnitude of disruption that’s coming their way,” says Gil Luria, who covers tech companies as a managing director for D.A. Davidson.

What’s happening with Nvidia symbolizes a broader story

Despite beating analysts’ expectations, and turning a handy $26.4 billion profit in its second quarter, Nvidia’s latest quarterly results disappointed Wall Street.

Even outside of the AI bubble, Nvidia has become a nexus for the bigger issues facing U.S. businesses — including mounting concerns over the future of free-market capitalism, and how much control President Trump is trying to exert over private companies.

Nvidia has been in the headlines this month for the extraordinary deal Trump announced with the company: He says Nvidia has agreed to pay the U.S. government a cut of sales of a certain chip in China, in exchange for letting the company do business there. (Nvidia said this week that it has not sold any of that chip in China in the past quarter.)

Trump announced that deal just before his administration said it would take a 10% stake in Intel, and that it is considering seeking similar deals in other industries. Those extraordinary arrangements have raised alarm bells in corporate America about how the U.S. government is exerting more control over the free markets. Meanwhile, investors are also still waiting to see the full impact of Trump’s sweeping tariffs on the broader economy.

But Pam Hegarty, who invests in tech companies as a lead portfolio manager at BNP Paribas, says Wall Street seems to be getting used to the political chaos around some of the artificial-intelligence industry.

“The tariffs and export controls have definitely added a lot of uncertainty, particularly for the semiconductor sector. But investors are starting to absorb that uncertainty,” she says, adding that she’s still optimistic about the broader AI boom: “The overall opportunity is still out there.”

Homeland Security suspends TSA PreCheck and Global Entry airport security programs

The U.S. Department of Homeland Security is suspending the TSA PreCheck and Global Entry airport security programs as a partial government shutdown continues.

FCC calls for more ‘patriotic, pro-America’ programming in runup to 250th anniversary

The "Pledge America Campaign" urges broadcasters to focus on programming that highlights "the historic accomplishments of this great nation from our founding through the Trump Administration today."

NASA’s Artemis II lunar mission may not launch in March after all

NASA says an "interrupted flow" of helium to the rocket system could require a rollback to the Vehicle Assembly Building. If it happens, NASA says the launch to the moon would be delayed until April.

Mississippi health system shuts down clinics statewide after ransomware attack

The attack was launched on Thursday and prompted hospital officials to close all of its 35 clinics across the state.

Blizzard conditions and high winds forecast for NYC, East coast

The winter storm is expected to bring blizzard conditions and possibly up to 2 feet of snow in New York City.

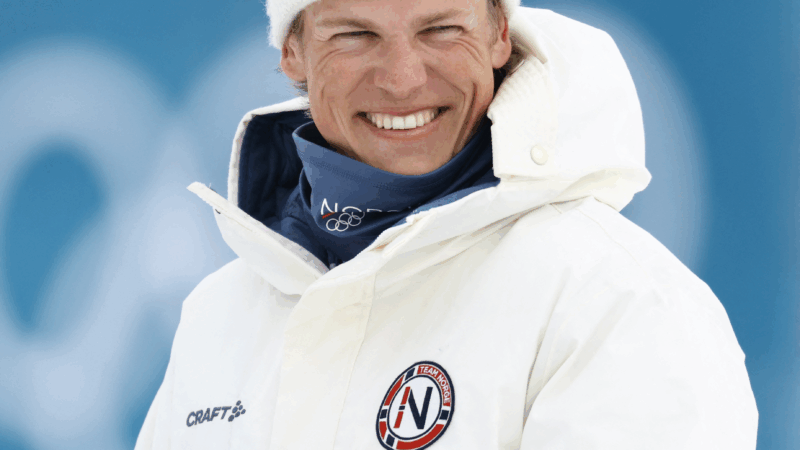

Norway’s Johannes Klæbo is new Winter Olympics king

Johannes Klaebo won all six cross-country skiing events at this year's Winter Olympics, the surpassing Eric Heiden's five golds in 1980.