A special newsletter to help you save money and pay off credit card debt

These days, it can feel impossible to stay on top of credit card debt. The cost of living is going up, inflation is on the rise and job growth is slowing.

And more Americans are falling behind on their bills. Credit card debt in the United States is at a record high. In the second quarter of 2025, credit card balances in the U.S. rose to $1.21 trillion, a 5.87% increase from a year ago, according to the Federal Reserve Bank of New York.

With interest rates often up around 20%, credit card debt can be a pretty big hole in your financial boat that you’d be better off plugging to keep yourself afloat.

That’s why Life Kit created a Guide to Paying Off Credit Card Debt. In this one-month newsletter series, financial educators explain how to create a credit card payment plan that works with your budget, so you can save money and make a meaningful dent in your debt.

How to sign up

To sign up for this newsletter series, click here and enter your email address. Over the course of a month, we’ll send you a weekly newsletter with tips on how to save money to put toward your debt. Sign up at any time to start your journey.

After this newsletter series ends, you’ll receive weekly emails from Life Kit on lifestyle topics such as health, money, relationships and more.

Strategies to pay down debt, right to your inbox

Whether you’ve hit a number on your balance that makes you feel uncomfortable, are behind on payments or just want to learn how to use your card responsibly, our series has tools for everyone. Here’s a sampling of what you’ll get in your inbox.

Here’s a sampling of what you’ll get in your inbox:

✅ How to reframe your relationship with debt

✅ Moves you can take right now to slow down the growth of your debt

✅ How to save money in your budget to put toward your debt

✅ How to decide which card to pay off first

✅ Expert advice on how to stay off the hamster wheel of debt

Paying off credit card debt is not impossible

People who carry a credit card balance often feel like they can never get out of debt. But that’s not true, says financial educator Rita-Soledad Fernández Paulino.

“I’ve had clients eliminate five figures of debt in about six months. Other [clients] can take 12 to 36 months,” she says.

The key is to set significant cash aside to throw at balances, she says. That’ll mean rethinking your spending habits or even finding extra sources of income (which we’ll explain how to do in our email series).

“When you’re paying only the minimums, most of your payment goes to interest, so the balance barely moves,” Fernández Paulino says. “And without enough monthly surplus, progress is slow.”

Ready to save money and create a financial plan to tackle your credit card debt? Sign up for Life Kit’s Guide to Paying Off Credit Card Debt to get started.

The digital story was edited by Clare Marie Schneider and Meghan Keane, with art direction by Beck Harlan. We’d love to hear from you. Leave us a voicemail at 202-216-9823, or email us at [email protected].

Listen to Life Kit on Apple Podcasts and Spotify, or sign up for our newsletter.

Travel industry pushes Congress to end DHS shutdown and pay federal security workers

With the busy spring break travel season looming, travel and aviation industry leaders urged Congress to end the stalemate over DHS funding before workers at TSA and ports miss a full paycheck.

Trump fires Kristi Noem as DHS chief, names Sen. Markwayne Mullin to replace her

President Trump has fired his homeland security secretary, Kristi Noem, and said Markwayne Mullin, a senator from Oklahoma, would replace her.

They were led off course in a big race. But a fix is more complicated than prize money

Top finishers in the Atlanta half marathon are calling for U.S. track officials to ensure that Jess McClain and two other athletes aren't excluded from the world championships because of an error.

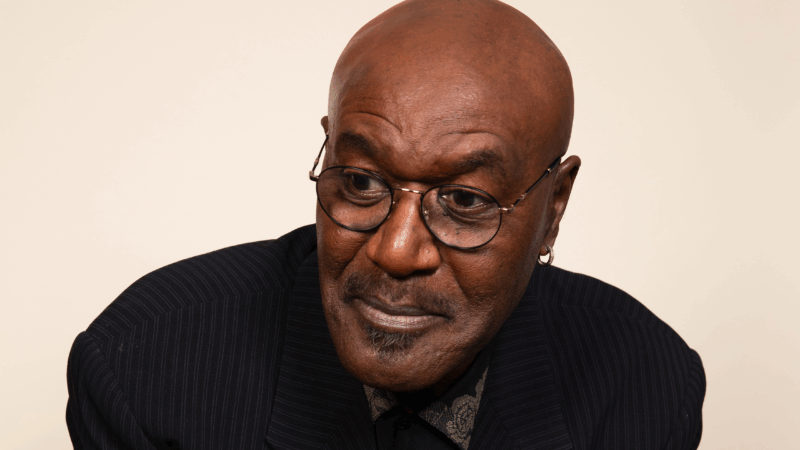

No matter what happens at the Oscars, Delroy Lindo embraces ‘the joy of this moment’

Lindo is nominated for best supporting actor for his role in Sinners. At the BAFTA awards on Sunday, Lindo was presenting when a man with Tourette syndrome in the audience yelled out a racial slur.

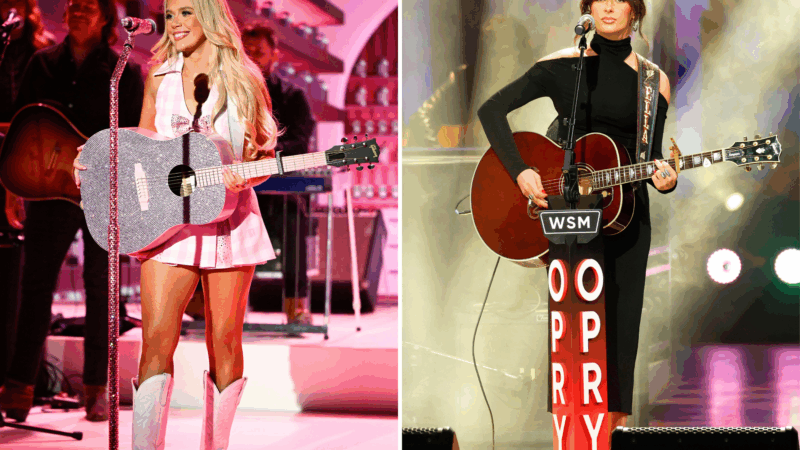

Between Megan Moroney and Ella Langley, country women rule the charts

It's a big week for women in country music — and, it turns out, for women whose songs are favored by women in figure skating.

A Jan. 6 rioter pardoned by Trump was sentenced to life in prison for child sex abuse

Since receiving presidential pardons, dozens of former Capitol rioters have gotten into more legal trouble. In Florida, Andrew Paul Johnson was sentenced to life in prison for child sex abuse.