Alabama House passes $192 million in tax cuts

Many lawmakers like tax cuts and evidence of that came this week when a package of $192 million in tax cuts flew through the Alabama House. We take a look at what’s in that package, alongside other action in Montgomery this week, with Todd Stacey, host of Capital Journal and Alabama Public Television.

The following conversation has been edited for clarity.

This is a $192 million package of tax cuts. Where are these tax cuts coming from?

Well, you may remember a couple of years ago, the legislature started the process of a gradual reduction and elimination of the sales tax on groceries. They took one penny off, but said, we need to take a penny off every time revenue reaches a certain level. So that really has led to only one penny coming off that four-cent sales tax. So they wanna accelerate that.

This legislation would go ahead and take that second [penny]. So it’s a 50% reduction in the state sales tax on groceries. That’s the biggest tax cut coming. So that penny would come off in the next fiscal year. The other legislation would allow localities, counties and cities, to remove their own sales taxes on groceries if they choose. The current law says they have to have revenue restrictions and things like that. That would be eliminated. So if your locality wanted to reduce its grocery sales tax just like the state, it could.

There’s also tax breaks for retirees, basically allowing retirees to withdraw more income from their retirement accounts without paying income tax. So that’s kind of a mix of where these tax cuts are coming from.

But what’s interesting and worth noting here is the big tax cut that is set to expire. And that is the tax cut on overtime pay. Two years ago, the legislature passed a bill eliminating the income tax on overtime wages. Problem was they estimated that it was gonna be only cost the state $30 million and ended up costing $300 million. That’s gonna expire this year. They’re kind of replacing that big tax cut that cost the state so much money and these more targeted tax cuts that they say reach more people because everybody pays grocery taxes.

Also, the Senate passed a bill that would affect how pharmacy benefit managers, the so-called middlemen in the system, reimburse pharmacies for drugs. This comes as particularly small pharmacies say they’re not reimbursed enough to cover their costs. Now, this proposal has changed a bit since we last talked about it, so how did it end up?

This has been a big fight this session because pharmacies, you’re right, especially local, smaller pharmacies are struggling financially because these large pharmacy benefit managers. They’re usually giant companies that negotiate drug prices with pharmaceutical companies. Pharmacies say they’re not being reimbursed nearly at a fair rate to be able to make a profit and stay in business. So this legislation would essentially mandate that these PBMs pay pharmacies for at least what the medication costs, plus a $10.64 fee. That number is what is paid through Medicare for reimbursement per prescription.

Pharmacies say that would allow them to be profitable and stay in business and not close down. But there’s been a pushback from the business community who say, look, if you charge that fee, that extra fee on every single prescription, it’s ultimately going to be born by businesses and their employees. They’ll see help that premiums go up. So there’s been a lot of negotiation and there was a lot of sausage being made on the Senate floor with amendments going back and forth. And they eventually reached something of a compromise that allowed everybody to be happy with it, at least for now. And so it passed unanimously in the Senate.

Finally, Gov. Kay Ivey signed a bill into law this week that would reorganize the Department of Veterans Affairs. Remind us what changes it makes.

So it elevates the Commissioner of Veterans Affairs to a cabinet level position and reorganizes the board. The Department of Veterans Affairs has kind of been a rogue agency, kind of a quasi, one foot in state government, one foot out. It was all controlled by the State Board of Veterans Affairs, a 17 member body that hired the director and made a lot of administrative decisions. That will now change. It will be an advisory board only. And so the director will now be a part of the governor’s cabinet with that direct chain of command and really, fully in state government.

All came out of that dust up you remember that we talked about last year so much between the Department of Veterans Affairs, the Department of Mental Health, the Department of Finance. It was all really messy. Had to do with what was characterized as malfeasance on the part of the commissioner. He was removed from office. And so this was all kind of born out of that. They want to reorganize it. make it fully in state government and ultimately more functional to actually serve veterans better.

The candy heir vs. chocolate skimpflation

The grandson of the Reese's Peanut Butter Cups creator has launched a campaign against The Hershey Company, which owns the Reese's brand. He wants them to stop skimping on ingredients.

Scientists make a pocket-sized AI brain with help from monkey neurons

A new study suggests AI systems could be a lot more efficient. Researchers were able to shrink an AI vision model to 1/1000th of its original size.

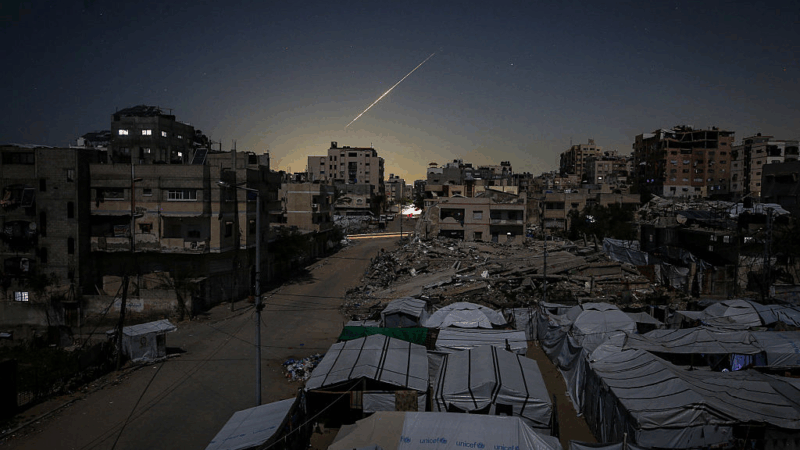

U.S. evacuates diplomats, shuts down some embassies as war enters fourth day

The United States evacuated diplomats across the Middle East and shut down some embassies as war with Iran intensified Tuesday while President Trump signaled the conflict could turn into extended war.

North Carolina and Texas have primary elections Tuesday. Here’s what you need to know

The midterm elections are officially underway and contests in Texas and North Carolina will be the first major opportunity for parties to hear from voters about what's important to them in 2026.

Kristi Noem set to face senators over DHS shutdown, immigration enforcement

The focus of the hearing is likely to be on how Kristi Noem is pursuing President Trump's mass deportation efforts in his second term, after two U.S. citizens were killed by immigration officers.

College students, professors are making their own AI rules. They don’t always agree

More than three years after ChatGPT debuted, AI has become a part of everyday life — and professors and students are still figuring out how or if they should use it.