Supply chain issues in California open up a business opportunity for Gulf Coast ports

All the cargo ships stuck waiting off the California coast begs a simple question: Why not sail to the Gulf Coast instead?

Politicians and southern port officials have been making just that call. Former Alabama House of Representatives member Paul DeMarco said the Port of Mobile can help solve the nation’s supply chain problems in a recent op-ed. The Port of New Orleans is also making its pitch to shipping companies during conferences and over social media.

Chief Commercial Officer Todd Rives shared with @WWLTV last week about Port NOLA’s growing breakbulk volumes and willingness to support the supply chain as we see national impacts. See the whole interview here:https://t.co/GZqUz8Z7UU #connectinglousianawiththeworld

— Port of New Orleans (@PortNOLA) November 15, 2021

So far, plenty of companies have listened. The Port of Mobile’s container volume went up 27% in September compared to the same time last year. The port credits at least part of that boost to more vessels coming from Asia. The Port of South Louisiana also saw growth, with 47% more tons of goods coming through during the second quarter of 2021. Experts say sea traffic shifting to these ports helps alleviate the supply chain’s problems.

But while some ships decided to dock in the South, plenty of others still wait in line off the California coast. That’s because problems like truck driver and shipping container shortages can’t be solved by changing ports.

“Some of the problems plaguing the West Coast ports, they’re not gonna just go away just because you shift from one area of the country to another,” said Chris Connor, American Association of Port Authorities president.

Even with the wait, it can actually be cheaper to stick with California. Companies have invested a lot more there in warehouses, rail lines, and other ground infrastructure, which experts say is where the real savings come from.

Ground transportation matters enough that some ships have long chosen to sail from Asia past the Gulf Coast to New York.

“Sometimes it’s cheaper than if you unload the stuff in California,” said Zikai Zhou, assistant professor at the University of Southern Mississippi. “Even if it looks like it’s a longer distance.”

Gulf Coast ports also deal more with exports than imports. And they certainly don’t deal with nearly the same volume as places like Long Beach, which handles more than 40% of the nation’s containerized imports.

Jay Chen, an associate professor with Cleveland State University, said scaling up southern ports isn’t a simple task, comparing it to modifying a Honda Civic for trucking.

“You cannot change a compact car to haul big trailers,” Chen said. “It’s just by design very, very different.”

But the shipping logjam in the Pacific shows that relying on just a few ports is not a good idea either — a handy argument for Gulf Coast officials as they compete for funding from the $17 billion set aside for ports in the recently passed federal infrastructure plan.

It would be too late to make much of a difference this time with this shipping crisis, but the money could go toward upgrading southern ports to better lend a hand the next time the supply chain gets knotted.

This story was produced by the Gulf States Newsroom, a collaboration between Mississippi Public Broadcasting, WBHM in Birmingham, Alabama, WWNO in New Orleans and NPR.

Pin trading has taken over the Olympics. Here’s what it’s like in Milan

Pin trading has become a hallmark of the Olympics in recent decades — and not just for athletes. An official trading center in Milan was a hotspot for longtime collectors and curious newcomers alike.

US military airlifts small reactor as Trump pushes to quickly deploy nuclear power

The Pentagon and the Energy Department have airlifted a small nuclear reactor from California to Utah, demonstrating what they say is potential for the U.S. to quickly deploy nuclear power for military and civilian use.

How Nazgul the wolfdog made his run for Winter Olympic glory in Italy

Nazgul isn't talking, but his owners come clean about how he got loose, got famous, and how they feel now

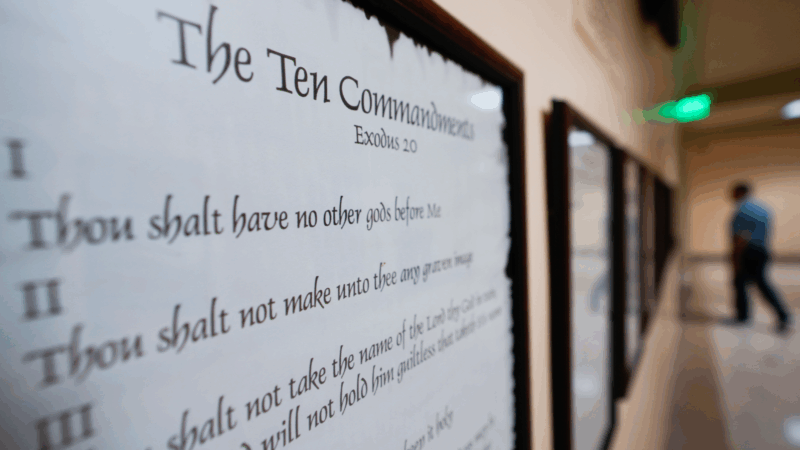

Court clears way for Louisiana law requiring Ten Commandments in classrooms to take effect

The 5th U.S. Circuit Court of Appeals has cleared the way for a Louisiana law requiring displays of the Ten Commandments in public classrooms to take effect.

From cubicles to kitchens: How empty offices are becoming homes

Many U.S. cities have too many office buildings and not enough homes. Developers are now converting some old offices into apartments and condos, but it's going slowly.

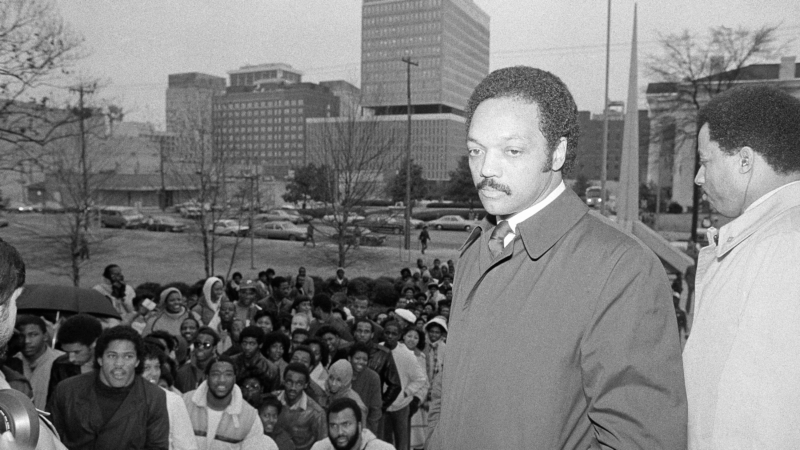

Opinion: The enduring dignity of Jesse Jackson

Rev. Jesse Jackson died this week at age 84. NPR's Scott Simon remembers covering Jackson's 1984 presidential campaign in Mississippi.