$25 Million Alabama Futures Fund: ‘This state is open for business for startups.’

Alabama’s startup scene grabbed eyeballs last year when Target bought Birmingham-based Shipt for $550 million. The city’s entrepreneurial community wants to keep that momentum going. One new effort is the Alabama Futures Fund. The $25 million fund will provide venture capital to new companies either in Alabama or to those willing to relocate here. WBHM’s Andrew Yeager spoke with Matt Hottle of Redhawk Advisory.

Interview Highlights

What companies the fund will invest in:

“What we really look at is there’s kind of three big pillars. The first thing we look at is the market that they’re going into. Is it a big enough market? Is it a market that has some size to it and has some opportunities within it. They we look at the founders themselves. Are they able to execute? Will they be adaptable? Because inevitably something’s not going to go right … And then the third thing is, is this scaling quickly or could this scale quickly. Something that’s going to take 20 years to get going, that’s probably not going to fit our investment thesis as we like to call it.”

The makeup of the fund:

“We have a split. A portion of the fund is for initial investments. And then a portion of the fund is going to be reserved for follow-on investments. And the reason that we’re doing that is that of the couple dozen investments that we’ll end up making, a handful will make it and the rest won’t … So we have to have this follow-on funding so that those teams that are succeeding, that are winning, that are moving forward, that are scaling, that we’re able to keep them going.”

The longterm goals of the fund:

“First and foremost, really get the message out that this state is open for business for startups. And capitalize on some of the stuff that’s already been massively successful in the last year … I think the second thing is that we really want to create this total lifecycle for companies. We don’t just want them to come here, get some funding, grow, get an investment from somewhere else and move. We want them to come here. We want them to grow. We want them to succeed. And then we want them, whatever that looks like, to then start seeding more companies, because that’s how real startup communities become startup giants.”

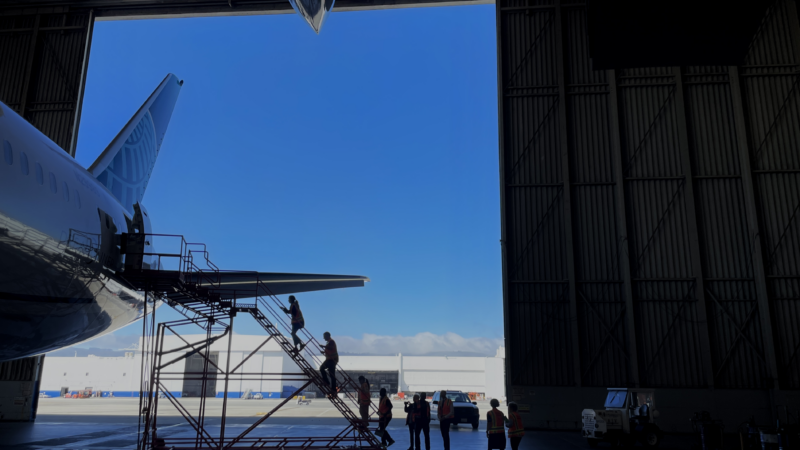

‘Fear of Flying Clinic’ helps anxious travelers back into the skies

For 50 years, a San Francisco-based group has created a space where fearful flyers can get supported exposure to air travel.

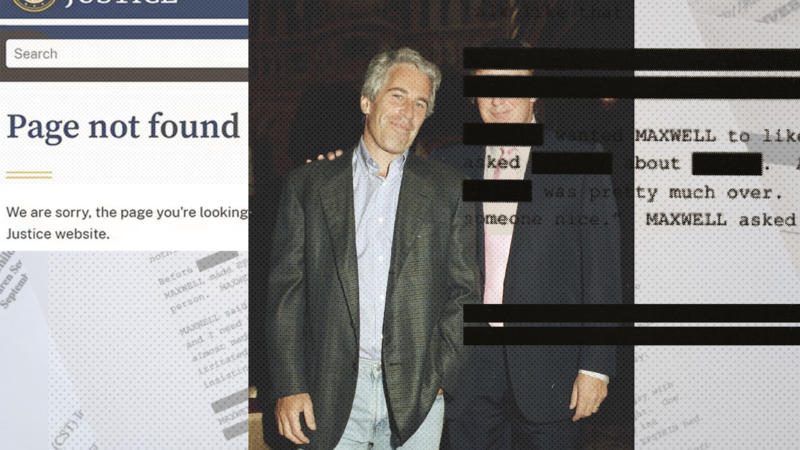

Justice Department withheld and removed some Epstein files related to Trump

An NPR investigation finds the public database of Epstein files is missing dozens of pages related to sexual abuse accusations against President Trump.

Why Gavin Newsom refuses to be a “bystander” in this political moment

What does the Democratic leader see for himself in the years to come?

These small business owners are owed tariff refunds. Will they ever get them?

Anyone who paid the taxes should get reimbursed, but the high court did not address how. Business owners wonder if they'll need lawyers, brokers, money — or luck.

FBI director invites fresh scrutiny over travels with appearance at US men’s hockey team celebration

When the American men's hockey team retreated to their locker room to celebrate their Winter Olympics gold medal win, they were joined by a special guest from the United States: FBI Director Kash Patel.

France moves to bar US Ambassador Charles Kushner from direct government access

France's top diplomat has requested that U.S. Ambassador Charles Kushner no longer be allowed direct access to members of the French government. Kushner skipped a meeting Monday to discuss comments by the Trump administration over the beating death of a far-right activist.