Alabama IRS Employee Pleads Guilty to Stealing Taxpayers Identities

An Alabama woman has pleaded guilty to identity theft and fraud in a tax scheme.

Nakeisha Hall worked for the Internal Revenue Service. Federal prosecutors say Hall’s job was to help taxpayers who had experienced problems with identity theft. Instead, Hall stole their identities and created fraudulent tax returns. She then collected refunds totaling more than a million dollars.

According to Hall’s plea, she obtained personal information including Social Security numbers through unauthorized access to IRS computers while working at the agency from 2008 to 2011.

A federal grand jury indicted Hall and three others in December. She faces a lengthy prison term and hundreds of thousands of dollars in fines and restitution.

Guerilla Toss embrace the ‘weird’ on new album

On You're Weird Now, the band leans into difference with help from producer Stephen Malkmus.

Nancy Guthrie search enters its second week as a purported deadline looms

"This is very valuable to us, and we will pay," Savannah Guthrie said in a new video message, seeking to communicate with people who say they're holding her mother.

Immigration courts fast-track hearings for Somali asylum claims

Their lawyers fear the notices are merely the first step toward the removal without due process of Somali asylum applicants in the country.

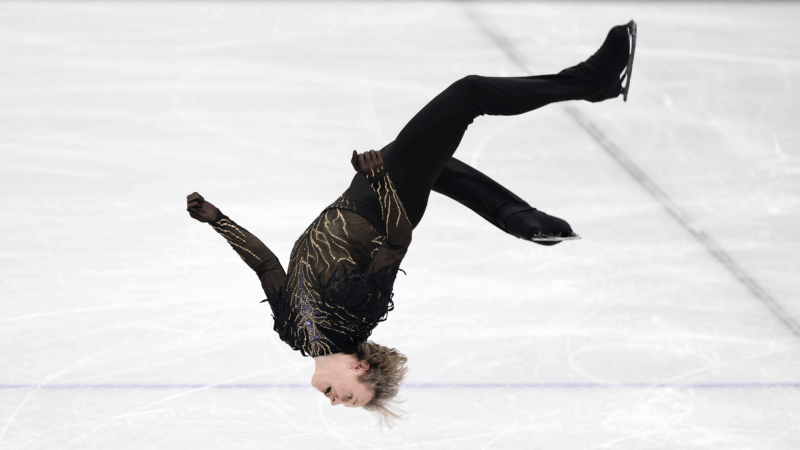

Ilia Malinin’s Olympic backflip made history. But he’s not the first to do it

U.S. figure skating phenom Ilia Malinin did a backflip in his Olympic debut, and another the next day. The controversial move was banned from competition for decades until 2024.

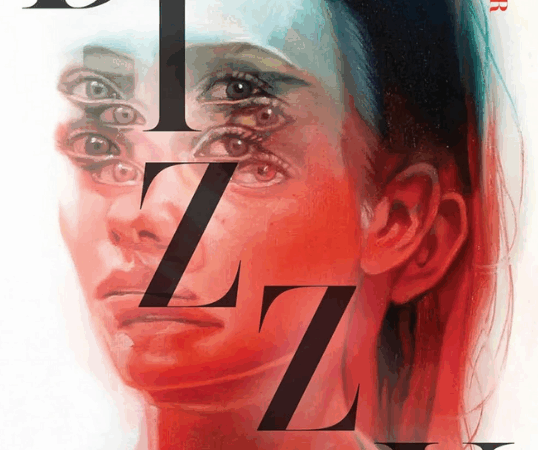

‘Dizzy’ author recounts a decade of being marooned by chronic illness

Rachel Weaver worked for the Forest Service in Alaska where she scaled towering trees to study nature. But in 2006, she woke up and felt like she was being spun in a hurricane. Her memoir is Dizzy.

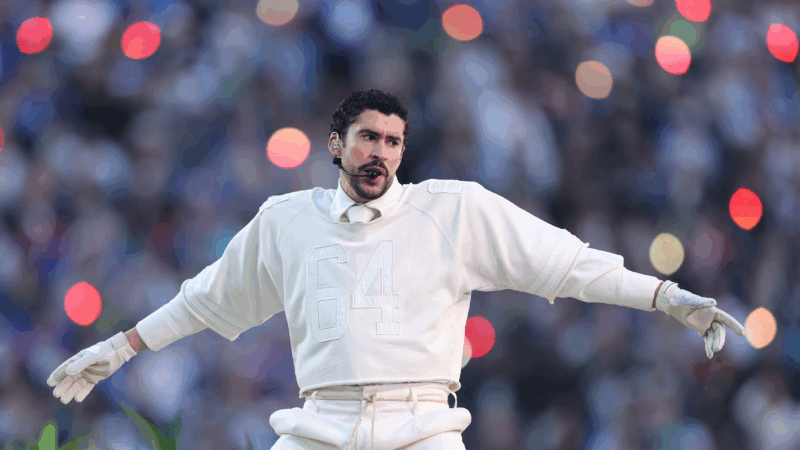

Bad Bunny makes Puerto Rico the home team in a vivid Super Bowl halftime show

The star filled his set with hits and familiar images from home, but also expanded his lens to make an argument about the place of Puerto Rico within a larger American context.