Judge Approves Jefferson County’s Plan to Exit Bankruptcy

Federal bankruptcy judge Thomas Bennett has confirmed Jefferson County’s bankruptcy plan, paving the way for the county to exit its $4.2 billion bankruptcy in December. Most of that debt was linked to corruption, mismanagement and bad deals around the county sewer system.

Thursday’s ruling ends two years under municipal bankruptcy, the second largest in U.S. history after Detroit’s filing earlier this year. County leaders say the confirmation allows Jefferson County move past its fiscal turmoil.

The plan calls for creditors to give up about $1.5 billion in concessions. Meanwhile, sewer customers will see their rates rise for 40 years. Businesses already took a 3.49 percent increase on November 1. Then for the next four years business and residential customer rates go up 7.89 percent. Sewer rates rise by 3.49 percent a year after that.

Jefferson County Commission President David Carrington is pleased the court approved the plan. He says the plan’s viability is shown through the fact the county was able to find investors to buy almost $1.8 billion in refinanced debt.

“They didn’t do it on a lark,” said Carrington. “They studied it. They understood it. They asked difficult questions.”

Jefferson County spent almost 26 million dollars in fees to lawyers and other groups through the process, but Carrington says it was worth it. After the county officially exits bankruptcy December 3rd, it can focus on economic development.

“What the county needs is more jobs, more business. That will stimulate a growth in population and it’ll stimulate housing developments and so we’re excited to move into the next phase of this commission,” Carrington said.

The judge turned back challenges from two groups of sewer customers, but they could appeal.

Critics say the plan could set things up for more problems down the line and point out the county’s debt payments rise dramatically after 10 years. Leaving the potential for more rate increases or a return trip to the bankruptcy court.

Andreas Rauterkus, finance professor at UAB, wasn’t surprised the judge approved the plan. But he says that jump in payments is concerning.

“For the county to be able to pay off or make the debt payments 10, 15, 20, 30, 40 years from now…there’s a lot of uncertainty there,” said Rauterkus.

He says it’s unlikely the county will be able to refinance under more favorable terms in 10 years, even with a better credit rating, because interest rates will probably be higher. Rauterkus also says the county may have difficulty attracting new sewer customers through economic development because of higher bills. He points to the future Interstate 22 which could be completed next year.

“A lot businesses in particular are gonna say I can just build in Walker County. I have the exact same connection to the interstate system but I can do it at a much lower cost,” said Rauterkus.

While much of the plan exists in the complex the world of municipal finance, those rate increases are what the general public will see. Dan Jones, owner of University Laundromat in Birmingham, is not happy about that.

Jones estimates says the rate increases that have already gone into effect for business will cost him an extra $600 a year. That eats into already thin profit margins or forces him to raise prices.

“That’s the last thing I want to do,” said Jones.

Jones doesn’t believe residents should have to pay higher rates given that corruption was a contributor to the massive bankruptcy.

“I deal in quarters down here. So you get talking it takes a lot quarters to make a billion dollars, but they’re trying to get it back a quarter at time from us and that’s not right,” Jones said.

The slogan for Jones’ laundromat is “wash, rise, repeat.” Jefferson County has been through the financial wash and rinsed off through bankruptcy. The question now is if in ten years it will repeat.

~ Andrew Yeager, November 22, 2013

Gulf South food banks look back on a challenging year as another shutdown looms

Federal funding cuts and a 43-day government shutdown made 2025 a chaotic year for Gulf South food banks. For many, the challenges provide a road map for 2026.

Measles is spreading fast in S.C. Here’s what it says about vaccine exemptions

More than 550 people have contracted measles in Spartanburg County, S.C., in a fast-growing outbreak. Like a majority of U.S. counties, nonmedical exemptions to school vaccination are also rising.

It took 75 governors to elect a woman. Spanberger will soon be at Virginia’s helm

Abigail Spanberger, a former CIA officer and three-term congresswoman, is breaking long-held traditions on inauguration day. She says she wants her swearing-in to showcase the state's modern vibrancy.

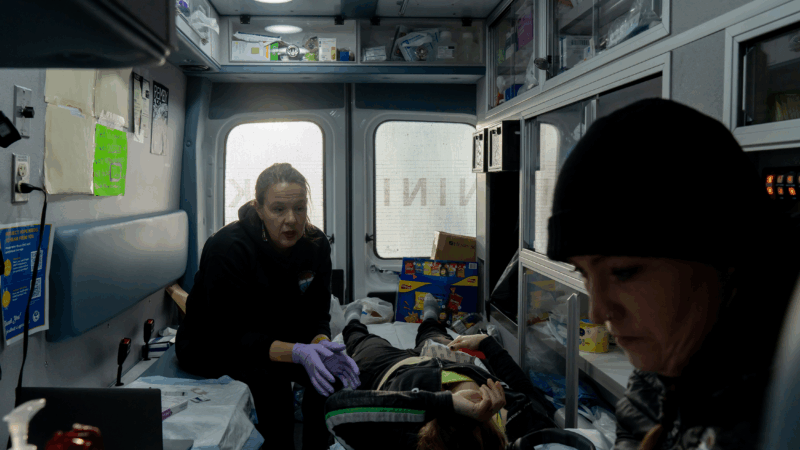

For those with addiction, going into and coming out of prison can be a minefield.

Many jails and prisons around the country don't provide medication treatment for opioid use disorder. Studies show that medication makes recovery more likely and reduces the risk of overdose death.

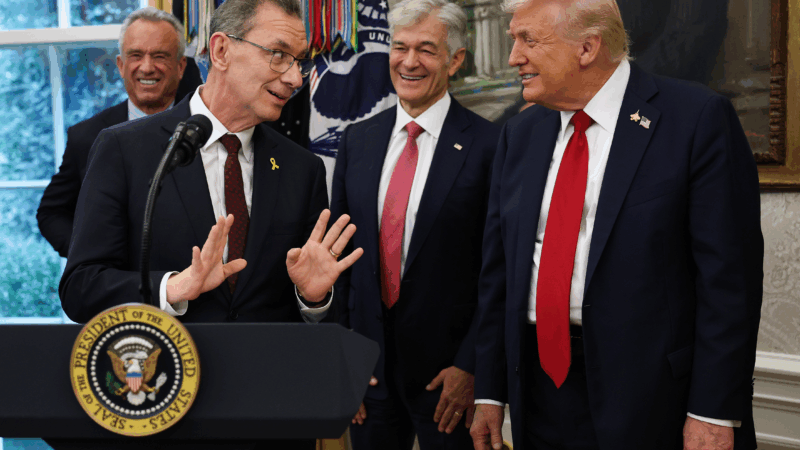

Trump struck deals with 16 drug companies. But they’re still raising prices this year

All 16 drug companies that inked deals with the Trump administration over the past few months still raised some of their prices for 2026.

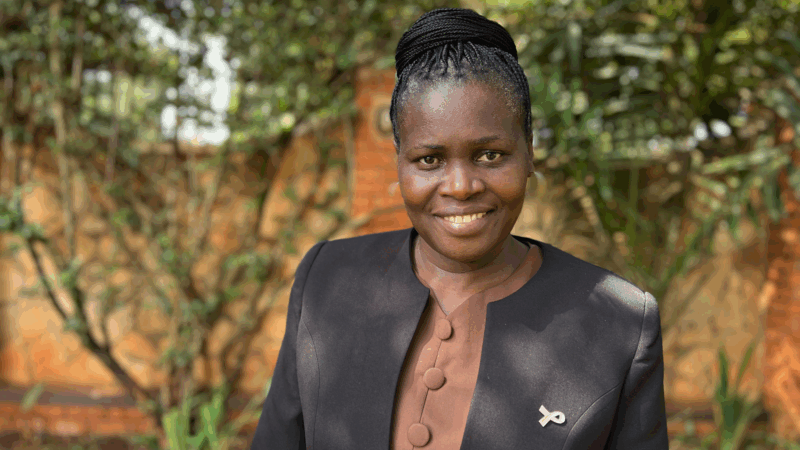

This hospice has a bold new mission: saving lives

A hospice in Uganda asked itself: Can we do more than ease the pain of dying? Can we actually prevent deaths from cervical and breast cancer?