Jefferson County Bankruptcy Round-Up

After multiple corruption trials, years of hand wringing and intense negotiations with creditors, Jefferson County is moving forward with what is the largest municipal bankruptcy in U.S. history. The $4.2 billion filing will take a while to sort out. And the WBHM News Team will be with you along the way reporting on the progress and the consequences. This is the collection of our stories to date:

November 2013 — A federal bankruptcy judge approves Jefferson County’s plan to exit bankruptcy, paving the way for the county to leave the $4.2 billion dollar bankruptcy in December.

June 2013 — WBHM’s Andrew Yeager reports on the tentative bankruptcy deal for NPR’s All Things Considered.

June 2013 — Jefferson County Commissioners approve a deal to end the county’s $4.2 billion dollar bankruptcy. The plan still must be approved by creditors and a judge, but it could clear the way for the county to exit bankruptcy by the end of the year.

February 2013 — The Birmingham News and Al.com’s Kyle Whitmire tells WBHM’s Andrew Yeager about a deal to lower interest rates, paving the the way to a possible bankruptcy deal.

January 2013 — The Birmingham News and Al.com’s Kyle Whitmire talks about closed door meetings designed to craft a plan to exit bankruptcy and a request by creditors to lift a stay on legal action against the county. The Birmingham News and Al.com columnist John Archibald offers his analysis on those closed door meetings.

November 2012 — On the first anniversary of Jefferson County’s municipal bankruptcy filing WBHM’s Andrew Yeager marks checks-up on the progress with Samford University law professor Mike Floyd.

November 2011 — WBHM’s Andrew Yeager discusses how Jefferson County’s municipal bankruptcy will proceed with Samford University law professor Mike Floyd.

November 2011 — Birmingham Business Journal editor Cindy Crawford discusses with WBHM’s Andrew Yeager what Jefferson County’s bankruptcy could mean for business.

November 2011 — Residents and employees react to Jefferson County’s bankruptcy filing in this story from WBHM’s Andrew Yeager for NPR’s Morning Edition.

November 2011 — Lawmakers in Jefferson County, Ala., voted Wednesday to file for bankruptcy. It will be the largest municipal bankruptcy in U.S. history. WBHM’s Tanya Ott talked with The Birmingham News’ John Archibald and was interviewed by NPR’s Guy Raz on All Things Considered. WBHM’s Andrew Yeager talked with Kyle Whitmire of Weld for Birmingham and was interviewed by PRI/WNYC’s The Takeaway.

September 2011 — Jefferson County Commissioners have two weeks left to reach a settlement with creditors over the county’s more than three billion dollar sewer debt. Commissioners have been negotiating directly with Wall Street banks in hopes of avoiding what would be the largest municipal bankruptcy in U.S. history. While approving a settlement is an important part of resolving the sewer debt crisis, that’s not the end. As WBHM’s Andrew Yeager reports, it just means a trip to Montgomery.

August 2011 — Jefferson County Commissioners will meet tomorrow to determine their next move as the county struggles with more than three billion dollars of sewer debt. They could reach a settlement with creditors or file what would be the largest municipal bankruptcy in U.S. history. But they’ll hold the meeting in executive session. That means meeting with lawyers, behind closed doors. And as WBHM’s Andrew Yeager reports that has some questioning if they’re violating Alabama’s open meetings law.

March 2011 — Jefferson County’s Occupational Tax is unconstitutional. That’s according to a unanimous ruling issued by the Alabama Supreme Court, which upholds a lower court’s ruling. Legislators enacted the tax in 2009, during a special session. The Supreme Court’s decision says legislators made changes to the bill that weren’t advertised. Legislators are required by law to advertise their bills. The loss of occupational tax revenue could cause financial trouble for county government. WBHM’s Bradley George spoke with Jefferson County Commission President David Carrington.

September 2010 — Jefferson County’s troubled sewer system will soon be run by a receiver. Judge Albert Johnson approved the receivership on Tuesday. Lawyers representing the trustees of the county’s 3 billion dollar sewer debt pushed for the receiver. They say the county has defaulted on its debt payments. But attorneys for the Jefferson County Commission are opposed to the idea, especially if the receiver has the power to raise sewer rates. So, what exactly is a receiver? And what power will he or she have? For answers to those questions, WBHM’s Bradley George spoke with Melissa Woodley of Samford University’s Brock of School of Business.

November 2009 — JP Morgan is paying more than $700 million to settle charges by the Securities and Exchange Commission it made unlawful payments to friends of Jefferson County commissioners in order to win municipal bond business. Under the settlement announced Wednesday, JP Morgan agreed to forfeit almost $650 million in bond-swap termination fees. The Wall Street bank will also pay a $25 million penalty and $50 million to Jefferson County. The SEC also took action against two former JP Morgan officials involved in the alleged scheme. They did not settle and an SEC spokesman said the government will continue to pursue the case against them. WBHM’s Bradley George discusses the case with Samford University finance professor Melissa Woodley.

October 2009 — A federal jury convicted the mayor of Birmingham, Ala., on bribery and corruption charges Wednesday. Larry Langford was removed from office, and he faces years in prison. WBHM’s Tanya Ott reports for NPR’s Morning Edition and talks with NPR’s Melissa Block of All Things Considered.

October 2009 — The mayor of Birmingham, Ala., goes on trial on federal bribery charges Monday. Larry Langford is accused of taking clothing, a Rolex watch and other bribes totaling some $235,000 while serving on the Jefferson County Commission. In exchange, prosecutors say Langford steered more than $7 million in county bond business to an investment banker. WBHM’s Tanya Ott reports for NPR’s Morning Edition.

September 2009 — This week on WBHM we’re exploring the culture of corruption in Alabama. Over the last several years, Birmingham and Jefferson County have experienced a tsunami of political corruption. From the HealthSouth accounting scandal to the convictions of several former county commissioners. And, of course, next month Birmingham Mayor Larry Langford goes on trial in a 101-count federal bribery and conspiracy case. Why does corruption seem to be such a problem in Alabama? What’s being done to address it? Listen to our special program On The Line: Alabama Corruption – What’s the Deal?

July 2009 — Jefferson County will put more than a thousand county employees on unpaid administrative leave next month under a plan to deal with the county’s budget crisis. Officials say without the move the county will be broke by August 7th. Governor Bob Riley has urged state lawmakers who represent Jefferson County to quickly back a $1 billion bailout plan. He wants to call a special session of the full legislature, which failed to find a solution during the regular session. How likely is a compromise, and will it be a long-term solution or a bandaid? Listen to our special program On The Line: The Jefferson County Budget Crisis.

June 2009 — Jefferson County officials are scrambling to determine how they failed to bill St. Vincent’s Hospital, UAB and others large facilities for nearly three-million dollars in sewer services. The problem came to light Monday in a federal court hearing over whether a receiver should take over management of the county’s sewer system. WBHM’s Tanya Ott spoke with county commissioners Bettye Fine Collins and Jim Carns.

February 2009 — The Washington DC lobbying firm that was to represent Jefferson County in its efforts to secure federal aid for sewer debt says it’s turning down the contract. In a letter made public today, Book Hill Partners says the “toxic political landscape” in Jefferson County would undermine the firm’s ability to get political support for the county. WBHM’s Tanya Ott spoke with partner Rob Housman.

January 2009 — New details are emerging about the Jefferson County Commission’s plan to spend hundreds of thousands of dollars on Washington D.C. lobbying firm Book Hill Partners. The commission approved the plan Tuesday in a meeting that commissioner Jim Carns describes as a cross between “The Twilight Zone” and “One Flew Over the Cuckoos Nest”. In this interview, Carns talks with WBHM’s Tanya Ott about the meeting and new allegations of corruption.

December 2008 — Birmingham Mayor Larry Langford is free on bond after being arrested today on a 101 count federal indictment alleging conspiracy, bribery, fraud, money laundering and filing false tax returns. He pleaded not guilty to what U-S Attorney Alice Martin says was a “classic pay to play scheme”. Langford allegedly accepted $235,000 in exchange for funneling millions of dollars of Jefferson County bond deals to Montgomery investment banker William Blount. Blount and lobbyist Al LaPierre also face charges. Birmingham City Councilwoman Valerie Abbott tells WBHM’s Tanya Ott it’s a sad day for the city. Listen to the interview here.

October 2008 — Jefferson County faces a bond payment deadline that it won’t be able to make, according to this story from WBHM’s Tanya Ott.

July 2008 — Since Birmingham, Ala., Mayor Larry Langford took office late last year, he’s been a man on a mission. His city has an annual budget of about $430 million, yet he’s proposed more than a billion dollars in new projects. But Langford’s ambitious agenda has been hobbled by charges that he accepted kickbacks in the past. Listen to Tanya Ott’s story that aired on NPR’s All Things Considered.

May 2008 — Birmingham Mayor Larry Langford is under a cloud of suspicion lately. Last week, the Securities and Exchange Commission filed a civil complaint against him. The S-E-C alleges that Langford accepted money from an investment banker who then got millions of dollars in contracts from the Jefferson County Commission, while Langford was a commissioner. Speculation abounds about the possibility of criminal charges. Mayor Langford sat down the WBHM’s Tanya Ott to talk about the allegations and his response. Listen to the interview here.

April 2008 — Tanya Ott reports on Jefferson County’s debt crisis for NPR’s All Things Considered. Listen to the story here.

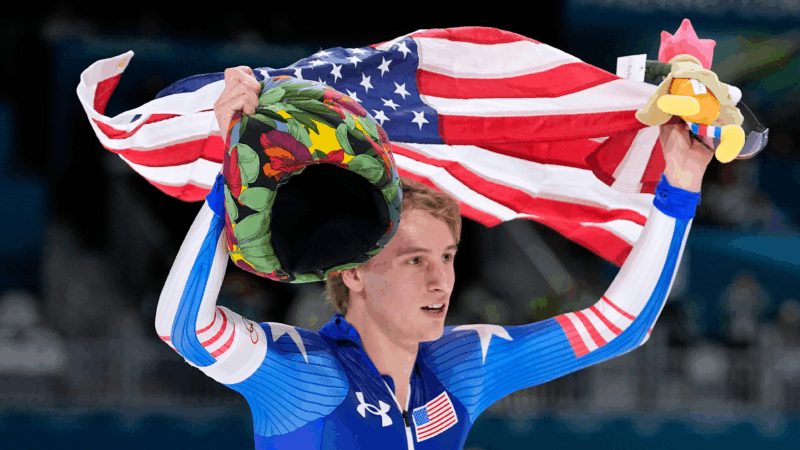

Jordan Stolz opens his bid for 4 golds by winning the 1,000 meters in speedskating

Stolz received his gold for winning the men's 1,000 meters at the Milan Cortina Games in an Olympic-record time thanks to a blistering closing stretch. Now Stolz will hope to add to his collection of trophies.

How the FBI might have gotten inaccessible camera footage from Nancy Guthrie’s house

Last week, law enforcement said video footage from Nancy Guthrie's doorbell camera was overwritten. But the FBI has since released footage as Guthrie still has not been found.

How to hone your ‘friendship intuition’

Friendship expert Kat Vellos shares tips on how to make a new friendship stick, including what to do together, how often to hang out — and what to do if the vibes just aren't there.

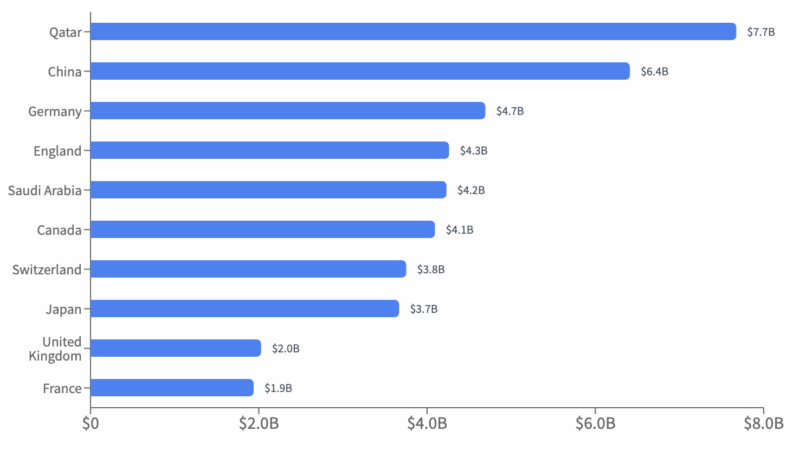

US Colleges received more than $5 billion in foreign gifts, contracts in 2025

New data from the U.S. Education Department show the extent of international gifts and contracts to colleges and universities.

Free speech lawsuits mount after Charlie Kirk assassination

Months after the killing of Charlie Kirk, a growing number of lawsuits by people claim they were illegally punished, fired and even arrested for making negative comments about Kirk.

Swing voters in Arizona say they want to see ICE reformed

Concerns about the tactics of federal immigration agents remain front of mind for some key voters who supported President Trump in 2024.