Trump thinks a weaker dollar is great for America. Is he right?

The dollar continues to sink — but is that a good thing for the U.S. economy?

President Trump seems to think so. On Tuesday, he said he welcomed the decline. Compared against a basket of major foreign currencies, the dollar is now the weakest it has been in four years.

“I think it’s great,” Trump said on Tuesday when addressing reporters. “Look at the business we’re doing. The dollar’s doing great.”

There are several reasons the dollar is down so sharply, including investors’ fears about the United States’ economic policies under Trump. And there are certainly benefits to a weaker dollar — including to domestic manufacturers. When the value of the dollar drops, American exports can become a little less expensive for buyers in other countries, hence making them more attractive.

But there’s a flip side: A weaker dollar means that goods imported into the U.S. from abroad can become more expensive.

Here are three things to know about the dollar’s decline.

Why is the dollar falling?

The dollar’s value has fallen about 2% so far this year after already tumbling by nearly 10% last year — the biggest annual decline since 2017.

This decline has been driven, in part, by concerns about Trump’s unpredictable — and often unorthodox — approach to economic policy, especially his use of tariffs against a slew of countries, as well as his frequent attacks against the Federal Reserve.

That has led to concerns that foreign investors, including central banks, will pare back some of their exposure to U.S. assets — though there are signs that this is not happening nearly as extensively as some had feared last year, when there were signs of a “Sell America” trade.

Still, one sign of a reduced appetite for American assets is that U.S. stock markets did not gain as much last year as some other global indexes. For example, the S&P 500 rose 16%, but that was not as much as other global markets did.

Another factor driving the decline is that the Federal Reserve has been cutting interest rates, lowering them three times in late 2025 before pausing this week. Generally speaking, higher rates tend to lead to higher currencies — and conversely, lower rates tend to lead to lower currencies, as has been the case with the dollar.

Are there benefits to a weaker dollar?

Yes, for sure. A key point Trump has made is that a weaker dollar helps domestic manufacturers by making their products more price-competitive abroad.

In fact, the Trump administration’s tariff policy has mainly been about supporting American industries and its workers against foreign competition.

American companies with significant sales abroad, such as Apple, can also benefit when converting their profits earned in foreign currencies into U.S. dollars (since they can get more dollars when making the conversion).

A weaker dollar also boosts the domestic tourism industry. It makes the country more attractive to foreign visitors, since their own currency buys them more dollars to use on vacation spending.

What are the drawbacks?

There are a few big ones. A weaker dollar tends to make stuff imported from abroad more expensive, a major issue given that the U.S. has traditionally imported more from abroad than it exports.

That can contribute to inflation by making things more expensive, not only for shoppers but also for manufacturers or other industries that need to import parts and raw materials from abroad.

And it can also make travel abroad more expensive for Americans. For years, the strong dollar helped make that trip to Paris or Madrid more affordable. But the euro has strengthened about 13% against the dollar over the past year, making that trip to see the Eiffel Tower or the Puerta del Sol a little more expensive.

Finally, one of the drawbacks is a bit more ephemeral. A country’s currency has usually been seen as a reflection of its standing in the global economy — and for years, the strong dollar was welcomed by the U.S. government as reflective of the country’s “exceptionalism.”

Sharp currency declines, by contrast, are seen as reflecting an erosion of confidence in a country. Those fears were at the heart of the “Sell America” trade last year.

Just a day after Trump’s remarks about the dollar, Treasury Secretary Scott Bessent went on CNBC to say that the U.S. hasn’t wavered in its commitment to a strong dollar, while also defending the president’s economic policies and saying they wouldn’t undermine confidence in America.

The “U.S. always has a strong dollar policy,” Bessent said.

“But a strong dollar policy means setting the right fundamentals,” he added. “If we have sound policies, the money will flow in.”

Birmingham Museum of Art brings a century of French Modernist works to town

Claude Monet and Henri Matisse may already be household names for fans of Impressionism, French painting or water lilies, but the Birmingham Museum of Art is offering a fresh look into 100 years of French modern art beyond the famed Frenchmen. It’s all in their newest exhibit Monet to Matisse: French Moderns, 1850–1950, opening Friday.

Trump taps Kevin Warsh to lead the Federal Reserve

Trump plans to nominate Kevin Warsh to be the next chair of the Federal Reserve, when Jerome Powell's term expires in May. The president has been pushing the central bank to slash interest rates.

Are you on a high-deductible health plan? What do you wish you knew?

People with ACA health insurance just saw prices surge and many switched to plans with high deductibles and health savings accounts. If that's you, what do you wish you knew about how your plan works?

U.S. life expectancy is going up. Think how many more news quizzes you can do!

When the news gets too heavy, the quiz is forced to turn to pop culture questions — so there are a lot this week. Let's see how you do!

Kari Lake promotes Trump on Voice of America. Does that break the law?

Critics say U.S. Agency for Global Media's Kari Lake risks making Voice of America sound like a propaganda outlet in her remarks on the air praising President Trump.

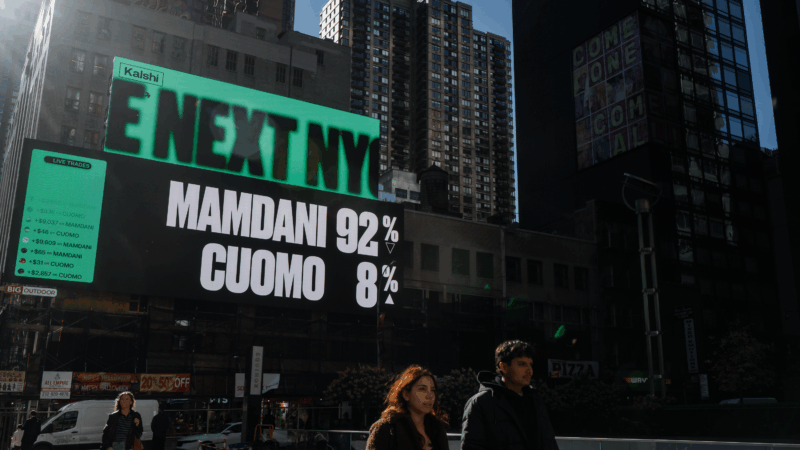

Kalshi in court over 19 federal lawsuits. What’s the future of prediction markets?

Apps that let people wager on current events have experienced explosive growth in Trump's second term. But one of the leading markets is tied up in lawsuits that cloud the industry's future.