She’s bracing and saving to pay $2,800 a month for ACA health insurance next year

Next year, when her health care premium balloons, “it’s gonna be a real hit,” Ellen Allen says. “I’m worried about it.”

Allen lives near Charleston, W.Va., and directs a nonprofit called West Virginians for Affordable Health Care. She buys her insurance on Healthcare.gov, and right now, the 63-year-old pays $479 a month. “I’ve been really happy with my coverage,” she says.

All of that is changing soon. The federal tax credit that makes the coverage affordable for Allen and millions of other Americans expires at the end of the year. The credit was a pandemic-era relief measure that has contributed to record enrollment in the insurance sold through the Affordable Care Act Marketplaces.

Average spike? 75%

The average enrollee will see their premium costs increase 75%, according to an analysis of insurance filings by the nonpartisan health research organization KFF. For many people, those increases will be even higher.

Allen, who’s well versed in these issues because of her job, used KFF’s online calculator to estimate what her premium will be after the enhanced subsidies expire.

“Next year it’s gonna be like $2,800 a month,” she says, just for her individual plan. She estimates that she could have $10,000 in out-of-pocket costs on top of that.

She says it’s still worth it to her to have the plan because she has expensive prescriptions. “Like an asthma medication [that] can run $700 a month. There’s an eye drop medication that can be $800 a month,” she says. “And these are the differences in keeping my vision, for example, so I have to do that.”

She’s started setting money aside every month and directing it into a separate account to start building up savings for those high premiums next year. “Luckily I can do that, but that’s money I won’t be able to save for investing in my 401K for retirement,” she says.

“I wish I were older”

One good thing, she says, is that she’ll turn 65 next year and be able to enroll in Medicare, so she will only be on the hook for the high premiums for eight or nine months. “It’s the first time in my life I wish I were older,” she laughs.

Rates could change before open enrollment for Healthcare.gov and the state-based marketplaces begins November 1. And Congress could also act before December to blunt the effect on enrollees, although the Republican lawmakers who control Congress have shown little interest in extending the subsidies. An extension of the tax credits was left out of President Trump’s tax and spending law passed in July.

People who can’t afford the higher premiums and are healthy enough will likely go without health insurance. Several enrollees told NPR that’s their plan — to roll the dice, taking the chance that they stay well and don’t have a big health expense.

The Congressional Budget Office estimates that the end of the enhanced tax credits will increase the number of uninsured people in the country by 4.2 million over the next decade. More Americans are also likely to become uninsured because of cuts to the Medicaid program in the law known as the “Big, Beautiful Bill.”

A new job, maybe a new wife

Sidney Clifton would really like to keep his Healthcare.gov plan. He says it works for him, and he has chronic health conditions. “Diabetes, I have congestive heart failure —just your normal overweight American, like everybody else,” he says.

Clifton is 54 and lives in Pasco County in central Florida. “I work for a car dealership — it’s a mom-and-pop store, not very big, like ten employees,” he says. He likes working for a small business, but it means no health benefits.

Right now, his full premium is about $1,100 per month, but with the enhanced subsidies, “my portion is $298.” He doesn’t know how much more he’ll have to pay every month next year without the subsidies.

“I could probably go up to $800 to $1,000,” he says. “$1,000 would be really, really pushing me hard.”

If it’s higher and he just can’t afford it, he says, he might look for a job at a bigger corporate dealership that has benefits.

Or, he says, “I’ll find me some woman [who has insurance] and get married again.” He says he’d rather not do that.

Transcript:

MARY LOUISE KELLY, HOST:

People who buy their own health insurance are facing significant price hikes next year. During the COVID-19 pandemic, Congress passed enhanced federal tax credits that made premiums more affordable. Those credits expire in December, and monthly costs will more than double for some enrollees. NPR’s Selena Simmons-Duffin talked to several people about the steps they are preparing to take.

ELLEN ALLEN: It’s going to be a real hit.

SELENA SIMMONS-DUFFIN, BYLINE: Right now, in late summer, Ellen Allen is thinking about her health care costs next January.

ALLEN: I’m worried about it. I mean, I’m already saving so I can pay my premium next year.

SIMMONS-DUFFIN: Allen lives near Charleston, West Virginia, and directs a nonprofit – one called West Virginians for Affordable Health Care, in fact. She buys her health plan on healthcare.gov.

ALLEN: I’ve been really happy with my coverage. With the enhanced premium tax credit, my monthly premium is $479 and some change.

SIMMONS-DUFFIN: Since she’s well versed on this topic because of her job, she used an online calculator to estimate what she will have to pay next year, when rates will be higher and there’ll be fewer federal credits.

ALLEN: Next year, it’s going to be like $2,800 (laughter) a month.

SIMMONS-DUFFIN: Just for her. And she estimates her out-of-pocket costs could be $10,000 on top of that. She says it’s still worth it to her to have the plan because she has expensive prescriptions.

ALLEN: Like, an asthma medication can run $700 a month. There’s a eye drop medication that can be $800 a month. And these are differences in, you know, keeping my vision, for example. So, you know, I have to do that.

SIMMONS-DUFFIN: One good thing is that she’ll turn 65 next year and be able to enroll in Medicare. So she won’t be on the hook for the high premiums for too long.

ALLEN: At least it’s for only nine months or eight months, and I’m glad I can do it. There will be a lot more West Virginians who can’t. And I’m glad I’m not 50 instead of (laughter) – it’s the first time in my life I wish I were older.

SIMMONS-DUFFIN: Sidney Clifton is in his 50s – 54, to be exact – so a long way from Medicare. He lives in Pasco County in central Florida.

SIDNEY CLIFTON: I work for a car dealership.

SIMMONS-DUFFIN: It’s a mom-and-pop operation with about 10 employees. He likes working for a small business, but it means no health benefits. And he has health issues he needs care for.

CLIFTON: Diabetes. I have congestive heart failure. Just your normal overweight American, like everybody else.

SIMMONS-DUFFIN: Right now, subsidies are keeping his costs down. The full premium is a lot.

CLIFTON: I think it’s 1,100. It was 1,100 and some this year. My portion is 298.

SIMMONS-DUFFIN: He really likes his plan. It works for him, and he’d like to keep it. But he doesn’t know how much more he’ll have to pay every month next year without the enhanced subsidies.

CLIFTON: I could probably go up to 800 to 1,000. A thousand would be really, really pushing me hard.

SIMMONS-DUFFIN: If it’s higher and he just can’t afford it, he says he might look for a job at a bigger corporate dealership that has benefits or…

CLIFTON: I’ll find me some woman and get married again – that has insurance.

SIMMONS-DUFFIN: He says he’d rather not do that. Rates could change before open enrollment begins, and Congress could also act before December to blunt the effects on enrollees. People who can’t afford the higher premiums and are healthy enough will likely go without insurance. Several enrollees told NPR that’s their plan, to roll the dice. The Congressional Budget Office estimates that the end of the enhanced tax credits will increase the number of uninsured people in the country by 4.2 million over the next decade. Open enrollment for healthcare.gov begins November 1.

Selena Simmons-Duffin, NPR News, Washington.

(SOUNDBITE OF MUSIC)

Trump’s harsh immigration tactics are taking a political hit

President Trump's popularity on one of his political strengths is in jeopardy.

A drop in CDC health alerts leaves doctors ‘flying blind’

Doctors and public health officials are concerned about the drop in health alerts from the Centers for Disease Control and Prevention since President Trump returned for a second term.

Photos: Highlights from the Winter Olympics opening ceremony

Athletes from around the world attended the 2026 Winter Olympics opening ceremony in Milan.

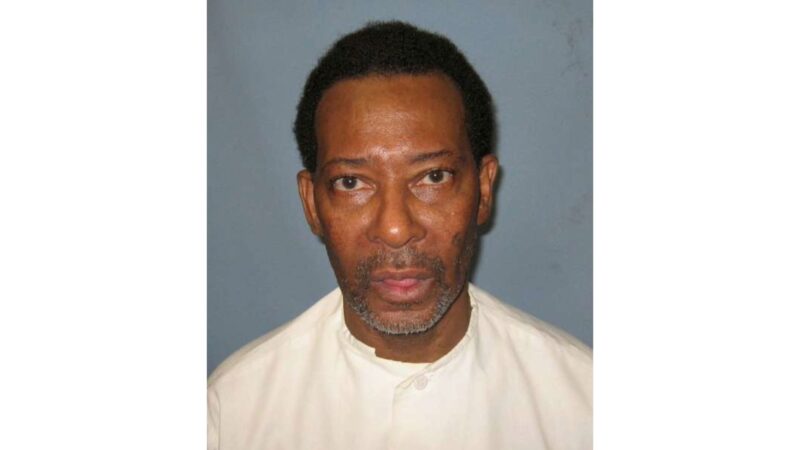

Alabama sets execution for man in auto parts store customer’s death

Gov. Kay Ivey on Thursday set a March 12 execution using nitrogen gas for Charles “Sonny” Burton. Burton was convicted as an accomplice in the shooting death of Doug Battle, a customer who was killed during an 1991 robbery of an auto parts store in Talladega.

Trump posts racist meme of the Obamas — then deletes it

Trump's racist post came at the end of a minute-long video promoting conspiracy theories about the 2020 election.

Hyperpop, poetry, BDSM or a Moroccan rave allegory? Choose your own cinematic adventure

Charli xcx is on more screens this weekend while Pillion tells a sweet BDSM story.