Insurance costs are soaring around Tornado Alley. Hail is the big problem.

The cost of homeowners insurance is soaring in states where large outbreaks of tornadoes are becoming more common. But it’s hail — not tornadoes — that are the biggest concern for insurers in the middle of the country, according to industry experts and analysts.

Insurance companies have been raising their rates as the cost of extreme weather disasters grows. In Kentucky, where at least 19 people died after a tornado tore through communities last week, premiums are up 35% from a few years ago, according to the Consumer Federation of America. It’s a similar picture throughout the region. Rates are up 35% in Nebraska, 34% in Arkansas, 32% in Minnesota and 27% in Texas, Colorado and Iowa.

“Even though tornadoes are a much more significant threat to life, most of the insured damages associated with severe weather come from hail,” says Scott St. George, head of weather and climate research at insurance broker WTW. “And the reason for that is because tornadoes are awful and they’re severe, but the footprint of those storms, the areas that are affected by them, is usually still pretty small.”

Hailstorms, on the other hand, cause damage across much larger areas. Hailstones, which can break windows, tear off siding and dent and even puncture roofing material, account for between half and 80% of homeowner insurance claims annually from severe convective storms — thunderstorms that can produce hail and tornadoes — according to St. George.

“My sense from the insurance industry is that hail has become an increasing contributor to claims in recent years due to frequency and severity,” says Ben Keys, a real estate and finance professor at The Wharton School at the University of Pennsylvania. “And so that is driving insurers to respond by raising premiums.”

It’s part of a trend that’s happening across the country. Insurance premiums have risen 24% on average in recent years, according to the Consumer Federation of America. Insurers say they have to raise rates because disasters are getting more expensive. People continue to move to coastal regions vulnerable to hurricanes and to rural parts of the western U.S. that are prone to wildfires. That means more property is in harm’s way. And when homes get damaged or destroyed, inflation has made it more expensive to rebuild.

Climate change is causing more extreme weather that damages and destroys property. However, climate change’s impact on tornadoes and hailstorms is still very much an area of active research.

‘Insurers are going to follow the same playbook’

There’s been an above-average number of tornadoes in the Midwest so far this year, according to data collected by the National Weather Service. That’s not evidence of a long-term trend. But tornado patterns are changing in other ways.

For example, large tornado outbreaks, like the ones in Kentucky and Missouri last week, are becoming more common, though scientists aren’t sure why. There’s also some evidence that the timing of tornadoes in the U.S. might shift, with more forming in the fall and winter. That could be because warm, wet air is an ingredient for tornadoes, and those conditions are becoming more common at times of the year that used to be colder and drier.

As for hail, a team of scientists last year said that as the Earth heats up, storms could produce larger hailstones due to changes in the atmosphere.

“The public is more aware of the wildfires and hurricanes and so on, but I assure you, the insurance industry is very aware of the severe convective storms and tornadoes and associated hail,” says David Marlett, managing director of the Brantley Risk & Insurance Center at Appalachian State University.

“Insurers are going to follow the same playbook” they’ve used in response to other threats, Marlett says. “They’re going to scale back coverage primarily on the roofs” — for example, by covering the value of a damaged roof rather than the cost of buying a new one — “and they are going to attempt to increase rates to match the risk.”

In some states, homeowners can qualify for insurance discounts if they make their homes more resilient, including by installing fortified roofs. But the discounts are often relatively small, so the investments usually take a long time to pay off.

“For the average homeowner, buying a $15,000 roof versus getting an $80 drop in your insurance just isn’t worth it for them,” says Jeremy Porter, head of climate implications research at First Street, which assesses property risks from climate change.

“When they’re thinking about bills that they have to pay for that year or for that month or even that week, it just doesn’t make sense for them financially to put on a new roof, because they’re not thinking long term,” Porter adds. “They’re thinking about the here and now and today.”

And while fortified roofs offer protection in hailstorms, tornadoes are a different story. Insurance experts say there’s only so much stronger roofs and tougher building codes can do in the face of big tornadoes.

“At some point with a tornado, you simply can’t build a structure that’s going to withstand that,” Marlett says.

Some Middle East flights resume, but thousands of travelers are still stranded by war

Limited flights out of the Middle East resumed on Monday. But hundreds of thousands of travelers are still stranded in the region after attacks on Iran by the U.S. and Israel.

‘Hamnet’ star Jessie Buckley looks for the ‘shadowy bits’ of her characters

Buckley has been nominated for a best actress Oscar for her portrayal of William Shakespeare's wife in Hamnet. The film "brought me into this next chapter of my life as a mother," Buckley says.

How, who, and why: NPR flips its famous letters to defend the right to be curious

NPR is standing up for the public's right to ask hard questions in a national campaign dubbed "For your right to be curious." At NPR's headquarters, on billboards in New York City, Chicago, and Washington, D.C., and across social media, NPR's three iconic letters transform into "how," "who," and "why" — a bold declaration of its commitment to fight for Americans' right to ask questions both big and small.

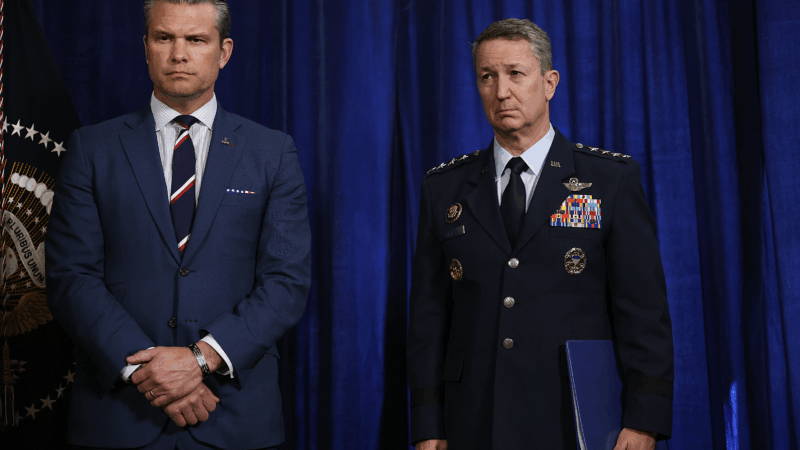

Hegseth: ‘We didn’t start this war but under President Trump we’re finishing it’

The remarks are the first to reporters since the U.S.-Israeli military operations against Iran began Saturday despite weeks of talks designed to stave off a conflict.

Ivermectin is making a post-pandemic comeback, among cancer patients

The anti-parasitic drug became a household name during the COVID-19 pandemic, and it is now being embraced as an alternative treatment for cancer. It is as politically polarizing as ever.

Rep. Adam Smith on the U.S. strikes on Iran and the debate over Trump’s war powers

NPR's Leila Fadel asks Democratic Rep. Adam Smith of Washington, the ranking member on the House Armed Services Committee, about President Trump's unilateral authorization to strike Iran.