Do you want federal money for an EV or home solar? Time is running out — fast

If you’ve wanted to install rooftop solar panels or buy an electric vehicle in recent years, you’ve probably been able to get federal money for them in the form of tax credits.

But those incentives are going away now that President Trump signed what he’s called the “One, Big Beautiful Bill” into law on July 4.

That means in the coming months there will be “a ‘hurry-up-and-buy’ ‘limited-time-offer’ kind of dynamic” to get these government incentives, says Ari Matusiak, CEO of the nonprofit Rewiring America.

“If you want to access them, then really you need to get going,” he says.

Here’s what you need to know about what’s happening to federal tax incentives for everything from solar panels to heat pumps to electric vehicles, and how much time you have to get that federal money.

Home solar tax credits end Dec. 31

The country’s first major climate policy under the Biden administration secured at least a decade of federal tax incentives for rooftop solar panels, solar water heaters, and geothermal heat pumps, says Sean Gallagher, vice president of policy for the Solar Energy Industries Association.

These technologies not only reduce climate pollution, they also make energy bills more affordable.

Scientists say that solar energy plus batteries, as well as energy-efficient appliances, are all reliable technologies that can save households money. Despite the evidence, White House spokesperson Taylor Rogers wrote in an email to NPR, “Instead of subsidizing unreliable energy sources at the expense of hardworking taxpayers, President Trump is unleashing American energy to lower costs to provide further relief for businesses and families.”

The tax credit meant homeowners could get up to 30% off the cost of installation or equipment. That tax incentive goes away Dec. 31.

Matusiak suggests that people sign a contract with a contractor, and pay for and install the project before the end of the calendar year so that they can secure their eligibility for the tax credit.

Solar project installation can take a few months and some contractors can have long wait times. That’s why he suggests talking to a contractor as soon as possible.

Another incentive for heat pumps and insulation ends Dec. 31

In addition to the 30% off investments in things like home solar, a federal incentive called the Energy Efficient Home Improvement Credit will also disappear later this year.

That credit meant up to $2,000 off heat pumps, water heaters, biomass stoves or biomass boilers on your tax bill. To qualify, appliances must have a high efficiency rating. Some manufacturer websites list tax credit-eligible equipment, as does the ENERGY STAR Product Finder.

The tax credit also offered up to $1,200 off home upgrades like new insulation, doors and windows.

To qualify for this tax credit it’s not enough to just purchase the equipment. They must be “placed in service” during the calendar year — another reason Matusiak suggests moving quickly.

Federal tax credits for electric vehicles end Sept. 30

Currently, some electric vehicle buyers are eligible for a federal tax credit worth up to $7,500 for buying or leasing a new EV, and up to $4,000 for a used vehicle. That money is available as a cash rebate at the time of purchase and can be used as a down payment. (Not every buyer and not every vehicle qualifies. You can read more about these credits here.)

The new law ends those credits after Sept. 30, over the protests of auto dealers, who said such a rapid change will be disruptive. Rogers at the White House wrote in an email to NPR that ending the tax incentives will “lower costs and incentivize Made in America products.”

Dealers are now scrambling to sell qualifying EVs on their lots before the tax credits disappear. “This is going to be the best time to buy an EV in a long time,” says Pat Ryan of the car-buying app CoPilot. “But, of course, that will go away when prices effectively go up when the rebate ends.”

The nonprofit research group Resources for the Future says that its modeling suggests EV sales as a share of the total U.S. market could contract by a third with the end of the credits.

That doesn’t mean the end of the EV industry, analysts say. “Automakers have spent literally billions of dollars building out supply chains,” says Joseph Yoon of the auto data company Edmunds. “I don’t think it’s just going to turn around and say, ‘Oh, well, that was a fun little experiment.'” But it could significantly reduce the pace of EV adoption, and as a result, lock in decades’ worth of future carbon pollution from the gas-powered vehicles being sold today.

EV tax credits do boost EV sales, but they require a high government expenditure for each additional sale they encourage; some economic research has suggested that putting money toward chargers is a more cost-effective policy approach. The Trump administration has been working to roll back charger funding, too.

The tax and spending package will end a credit available to businesses and individuals to help with the costs of installing EV chargers, specifically in low-income or rural areas. That credit, which covers 30% of the installation cost, will end June 30, 2026. Separately, the Trump administration has also frozen funding to build high-speed EV chargers on highways, a move that some states are currently challenging in court.

There’s still money available from some states and utilities, for now

Some local utility companies offer incentives for technologies like heat pumps, residential solar, or insulation, so experts suggest checking in with your local utility.

The country’s major climate legislation in 2022 gave more than $8.5 billion to states, including Arizona, Georgia, New York, and Wisconsin, to help them expand or establish rebate programs for home green technology upgrades. Much of that money is still available.

Rewiring America and another nonprofit called The Switch is On have online tools that can help people, in most states, plug in their zip codes and incomes to search for the federal, state, local, and utility company incentives for which they’re qualified. Consumers can also check for incentives at an online database from the N.C. Clean Energy Technology Center.

Still, because a lot of state rebate money is tied to Biden-era policies, experts also suggest looking into those sooner rather than later. Lowell Ungar, head of federal policy at The American Council for an Energy-Efficient Economy, a nonprofit research organization, doesn’t think most states will run out of rebate money this year, but he adds, “eventually they will run out of money and then there won’t be any further federal help.”

With a win over Sweden, the U.S. men’s hockey team will play for an Olympic medal

A thrilling overtime goal by defenseman Quinn Hughes puts Team USA through to a semifinal game against Slovakia. On the other side of the bracket, Canada had its own close call, but moves on to face Finland.

Zuckerberg grilled about Meta’s strategy to target ‘teens’ and ‘tweens’

The billionaire tech mogul's testimony was part of a landmark social media addiction trial in Los Angeles. The jury's verdict in the case could shape how some 1,600 other pending cases from families and school districts are resolved.

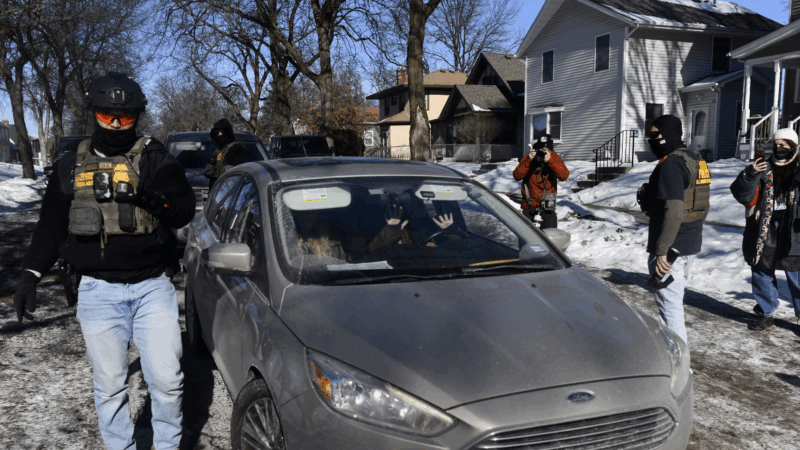

The Trump administration is increasingly trying to criminalize observing ICE

ICE officers often tell people tracking and watching them that they are breaking federal law in doing so, but legal experts say the vast majority of observers are exercising their constitutional rights.

8 backcountry skiers found dead and 1 still missing after California avalanche

Authorities say the bodies of eight backcountry skiers have been found and one remains missing after an avalanche near Lake Tahoe in California. Six others were found alive.

FDA reverses course on Moderna flu shot

The Food and Drug Administration's about-face comes a little more than a week after the agency refused to consider the company's application to market the new kind of influenza vaccine.

Following Trump’s lead, Alabama seeks to limit environmental regulations

The Alabama Legislature on Tuesday approved legislation backed by business groups that would prevent state agencies from setting restrictions on pollutants and hazardous substances exceeding those set by the federal government. In areas where no federal standard exists, the state could adopt new rules only if there is a “direct causal link” between exposure to harmful emissions and “manifest bodily harm” to humans.