A $400,000 profit on Maduro’s capture raises insider trading questions on Polymarket

For one prediction market trader, the Trump administration’s weekend capture of Venezuelan leader Nicolás Maduro was a nearly half-million-dollar payday.

On Polymarket, a popular site for making bets on the outcome of real world events, a user wagered $32,000 that Maduro would be toppled by the end of January hours before Trump ordered the operation. When it was clear the U.S. had captured Maduro, the trader made more than $400,000 in profit.

Was the trader just lucky, or privy to classified government deliberations? For now, it’s impossible to tell.

Online sleuths have attempted to identify this trader with no luck. The account, which originally went by the handle “Burdensome-Mix” before changing its display name to a string of letters and numbers, joined Polymarket just weeks ahead of making the Maduro trade.

Most traders on prediction markets like Polymarket and Kalshi place bets under pseudonyms, not their real names. Yet if the accounts are linked to cryptocurrency wallets, it is sometimes possible to unmask a user.

Chainalysis, a company that tracks crypto theft, told NPR it cannot determine the person behind the account, but noted that they are using several U.S. crypto exchanges to cash out, suggesting they are not trying to conceal their identity by funneling money through shadowy overseas exchanges, something that is typical in crypto fraud schemes.

“Was it insider trading? Hard to say,” said Daniel Taylor, a professor at the University of Pennsylvania’s Wharton School who studies insider trading and corporate fraud. “It’s easier in hindsight to pick out things that look suspicious than to pick them out in real time.”

In the case of the person who placed the lucrative Maduro wager, the mystery rages on, but it has sparked debate about the potential for insider trading on prediction markets, where financial experts say abuse can go unnoticed by federal regulators.

Unlike the stock market, where the Securities and Exchange Commission polices market activity for potential insider trading, far fewer guardrails are in place to keep prediction markets in line.

Polymarket and its rival, Kalshi, fall under the supervision of the Commodity Futures Trading Commission. The agency can enforce anti-fraud rules including instances of insider trading. But the agency has about one-eighth the staff of the SEC, despite Kalshi alone receiving more than $2 billion in trades in a single week.

The president’s son, Donald Trump Jr., is an adviser to both Polymarket and Kalshi, which makes some experts skeptical that the agency will ever go too hard on the companies.

“Given the conflicted relationship of the First Family,” said Yale School of Management professor Jeffrey Sonnenfeld, “CFTC oversight could be compromised.”

Yash Kanoria, a professor at Columbia Business School, agreed that the companies’ ties to the Trump administration undermine faith that regulators will aggressively monitor the platforms for traders seeking to rig bets.

“We need them to be invested in weeding out bad activity like insider trading, without any distracting influences,” he said.

The CFTC and Polymarket did not return requests for comment.

Kalshi said in a statement that the platform prohibits insider trader “including government employees trading on prediction markets related to government activity.” Similarly, Polymarket’s rules prohibit market manipulation more generally.

The Biden administration cracked down on prediction markets, fighting them in court over allowing bets on U.S. elections and pushing back against sports betting, which is outlawed in nearly 20 states.

Trump’s regulators have taken the opposite approach. The Justice Department and CFTC have dropped investigations into prediction markets. Trump’s own social media site, TruthSocial, has announced plans to introduce its own prediction market.

There have been other instances of potential insider trading on Polymarket, like when someone netted nearly $1 million by correctly betting on what 22 out of 23 of Google’s most-searched terms would be last year.

The University of Pennsylvania’s Taylor says even if it can be shown that someone used non-public information to make money on a prediction market, a successful prosecution would hinge on showing harm.

“How would the U.S. government be harmed by someone trading on advanced warning of the Maduro operation?” he said. “If you can’t show that you’re depriving someone of value, it’s going to be a very difficult case.”

Have information you want to share about the Maduro trade or insider trading on prediction markets? Bobby Allyn is available via the encrypted messaging app Signal at ballyn.77.

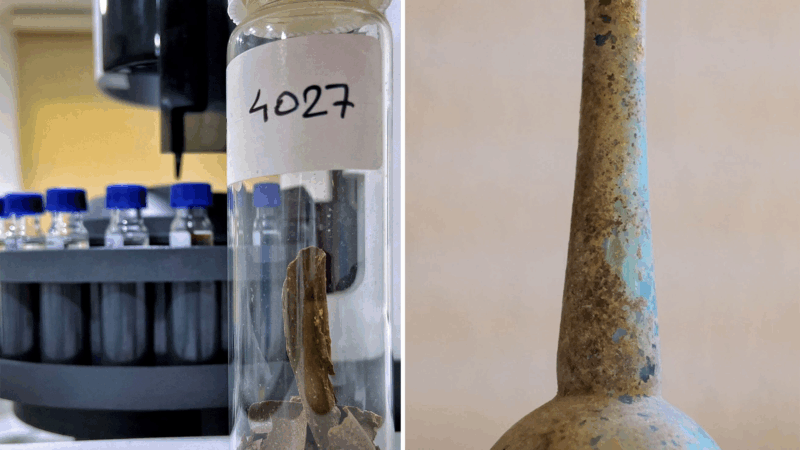

That ain’t perfume! Ancient bottle contained feces, likely used for medicine

Researchers found a tiny bottle from ancient Rome that contained fecal residue and traces of aromatics, offering evidence that poop was used medicinally more than 2,000 years ago.

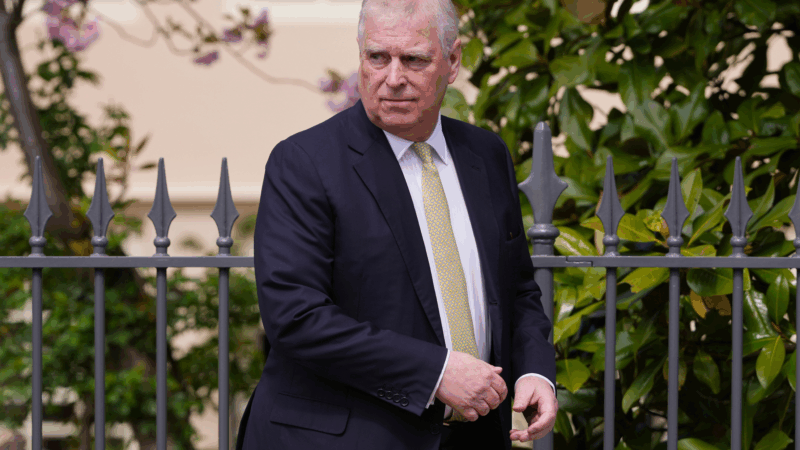

Britain’s former Prince Andrew arrested on suspicion of misconduct in public office

Andrew Mountbatten-Windsor, formerly Prince Andrew, has been arrested on suspicion of misconduct in public office.

Urban sketchers find the sublime in the city block

Sketchers say making art together in urban environments allows them to create a record of a moment and to notice a little bit more about the city they see every day.

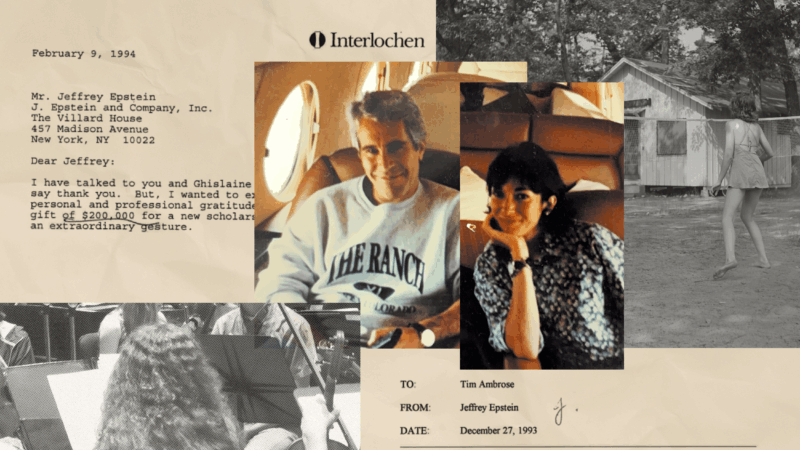

Epstein once attended an elite arts camp. Years later, he used it to find his victims

Jeffrey Epstein and Ghislaine Maxwell lavished money on the Interlochen Center for the Arts to gain access, documents show — even funding an on-campus lodge they stayed in. In the process, two teenagers were pulled into their orbit.

How a recent shift in DNA sleuthing might help investigators in the Nancy Guthrie case

DNA science has helped solve criminal cases for decades. But increasingly, investigative genetic genealogy — which was first used for cold cases — is helping to solve active cases as well.

An unsung hero stepped in to help a newly widowed mom in a moment of need

Barbara Alvarez lost her husband in 2017, just before their daughter went off to college. Her unsung hero helped her find the strength to be a single mother to her child at a key moment in their lives.