Alabama study reveals hurricane resilience programs are paying off for homeowners and insurers

By Gabriela Aoun Angueira

A new Alabama study of hurricane-affected homes sends a clear message to insurers and homeowners nationwide: climate-resilient construction methods can protect homes, and save a lot of money.

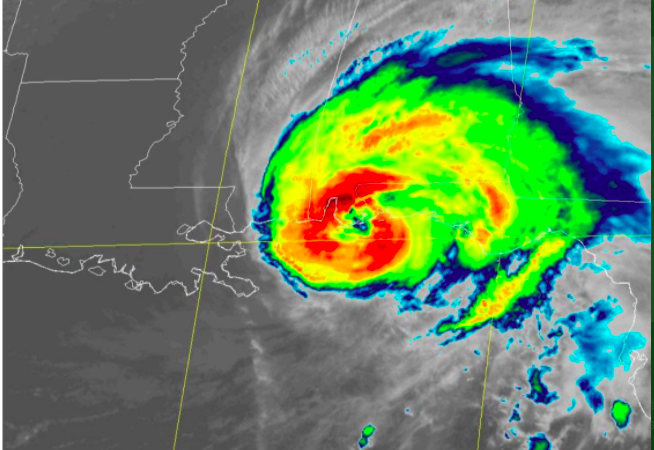

The first-of-its-kind analysis, released last week, reviews thousands of insurance claims linked to Hurricane Sally, which struck Alabama’s coast in 2020 with wind speeds up to 105 miles per hour. Homes retrofitted or built to Fortified standards, a voluntary construction code created by the nonprofit Insurance Institute for Building and Home Safety (IBHS) for wind and rain mitigation saw significantly fewer and less costly claims.

If every impacted house in Mobile and Baldwin counties had met Fortified standards, insurance companies could have spent 75% less in payouts, saving up to $112 million, and policyholders could have paid up to 65% less in deductibles, saving almost $35 million, according to the study.

The results show “mitigation works and that we can build things that are resilient to climate change,” said Dr. Lars Powell, director of the Center for Risk and Insurance Research at the University of Alabama’s Culverhouse College of Business, which led the study with the Alabama Department of Insurance.

Across the United States, insurance markets are buckling under the pressure of more frequent and expensive climate events, and federal support is shrinking for resilience projects that could reduce that damage. Officials and researchers involved with the study say it proves Alabama’s proactive approach to the challenge — mandatory, sizable insurance discounts for those who use Fortified and a grant program to help them afford it — could be a national model for increasing insurability and safety.

IBHS created Fortified to strengthen buildings against storm damage based on decades of research at its facility, where it uses a giant wind tunnel to pummel model houses with rain, hail, and wind up to 130 miles per hour.

“We are having record breaking year after record breaking year of disasters and insured losses, and we have been searching for meaningful ways to reduce the severity and the frequency of those losses,” said Fred Malik, managing director of the Fortified program.

The three levels of designations — Fortified Roof, Silver and Gold — employ methods like improving roof fasteners, using impact-rated doors and windows, and more securely anchoring walls to their foundation. The program requires third-party verification of work.

About 80,000 homes across 32 states now have Fortified designations, with over 53,000 in Alabama.

The state began looking for ways to improve storm outcomes after Hurricane Ivan in 2004 jolted the state’s insurance market. “Ivan was absolutely devastating,” said Alabama Insurance Commissioner Mark Fowler. “Our market was going crazy, insurers were leaving.”

It became the only state to implement mandatory minimum insurance discounts for Fortified homes, currently as much as half off the wind portion of homeowners’ premiums. It also launched the Strengthen Alabama Homes incentive program, offering grants of up to $10,000 for homeowners retrofitting their houses to Fortified standards.

The state has doled out $86 million for 8,700 Fortified retrofits since 2015. Fowler credits the initiative with also catalyzing demand for new Fortified construction and incentivizing contractors and inspectors to learn the standards.

“It worked like gangbusters,” he said. “We’ve seen the market substantially stabilized.”

Hurricane Sally offered researchers their first chance to assess the program’s benefits in a real storm. “It really was a prototypical storm that anybody who lives on the hurricane coast is liable to see in any given year,” said Malik.

They collected insurance data on more than 40,000 houses in the affected area — a total insured value of $17 billion.

Fortified construction reduced claim frequency by 55% to 74%, depending on the designation level, and loss severity by 14% to 40%. Despite representing almost one-quarter of the policies studied, Fortified homes accounted for only 9% of claims.

They even fared better than houses built to similar codes but without the official designation, likely due to the program’s more stringent verification requirements.

“It really does start to bring home that there is value for everybody involved,” said Malik. “There’s value for the insurers, there’s value for the homeowner.”

Fortified doesn’t address all types of hurricane losses. Nearly half the claims in the study were from fallen trees, which require separate mitigation strategies.

The enhanced standards do add cost: between 0.5% to 3% more for new construction, and 6% to 16% for retrofits. But the longterm benefits have spurred even disaster recovery nonprofits like Habitat for Humanity, Team Rubicon and SBP to use Fortified, often with the philanthropic support of insurers like Travelers and Allstate.

“Helping disaster-impacted homeowners build back smarter with storm-resilient construction and IBHS Fortified standards helps break the cycle of disaster and loss,” said Thomas Corley, chief operating officer at the New Orleans-based nonprofit SBP, which has built 671 homes to Fortified standards in nine states.

The potential insurance discounts also help recovering families by lowering their monthly expenses and boosting confidence that they can keep affording their homes. “For low-income families, this could mean the difference between upward mobility or years of financial instability after a disaster,” said Corley.

Alabama is expanding its grant program to three new counties this year. Fowler said he hopes the results encourage more insurance companies to offer wind protection on coastal homes, and that adoption will spread to less hurricane-prone areas still susceptible to severe weather.

The approach has caught the attention of other states seeking resilience solutions. Fowler spoke before a California legislative committee last month in support of the California Safe Homes Act, a proposed bill that would fund grants for fire-safe roofing and defensible space to protect from wildfires.

“Natural disasters like windstorms, earthquakes, or wildfires will come no matter what we do,” he told the committee. “That means you must find ways to build stronger before the event so you will have less damage after the event. It’s actually a pretty simple concept.”

Why is the U.S. attacking Iran? Six things to know

The U.S. and Israel launched military strikes in Iran, targeting Khamenei and the Iranian president. "Operation Epic Fury" will be "massive and ongoing," President Trump said Saturday morning.

Sen. Tim Kaine calls on the Senate to vote on the war powers resolution

NPR's Scott Simon talks to Sen. Tim Kaine, D-Va., about the U.S. strikes on Iran.

Political science expert weighs in on Iran’s nuclear program in light of U.S. strikes

NPR's Scott Simon speaks to Ariane Tabatabai, the Public Service Fellow at Lawfare, about U.S. attacks on Iran and how President Trump's calls for regime change might be received there.

Week in Politics: Does Trump have political support for his actions in Iran?

We look at what President Trump's decision to attack Iran means, what kind of support he has in Iran and what this moment means for his administration.

Unlocking the secrets of an ancient plague

The first historically recorded pandemic is believed to have struck the walled city of Jirash, in what is now modern-day Jordan, in the 7th century. A new study reveals details about those who died.

Panic, fury, and some hope, in Iran as U.S. launches strikes

In Tehran, panicked residents rushed home to shelter and terrified children poured out of classrooms as U.S. air strikes hit the capitol.