Sales Tax

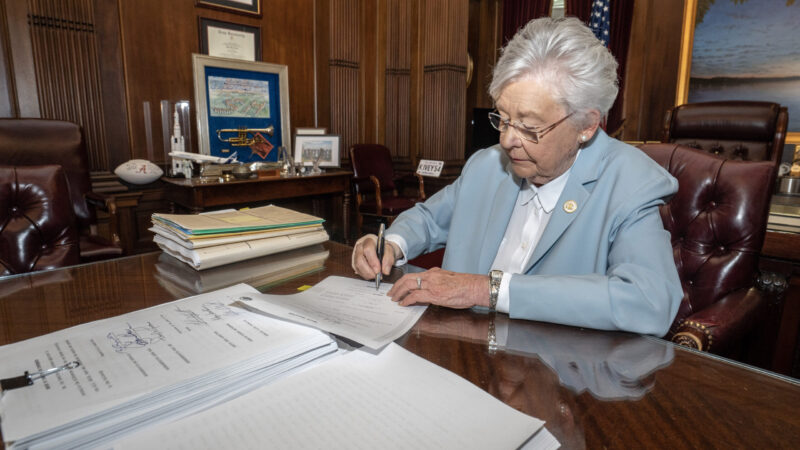

Ivey signs grocery tax reduction into law

Alabama is one of only three states that tax groceries at the same rate as other purchases. Advocates had long argued that taxing food at such a rate placed an unfair burden on families.

Major bills cross the finish line with one day left in legislative session

Gov. Kay Ivey signed both budgets and supplemental spending packages Thursday. A plan to reduce the state sales tax on food is on the way to her desk as well.

After decades of attempts, major bill to cut state’s 4% grocery tax wins final passage

The legislation now heads to the desk of Gov. Kay Ivey, whose office said she will review it when she receives it. Alabama is one of only three states that tax groceries at the same rate as other purchases.

Budgets head to the governor after early morning vote

Alabama lawmakers gave final passage to an $8.8 billion education budget and $3 billion general fund budget early Friday morning. That doesn’t count supplemental spending plans.

Alabama senators back bill to cut state sales tax on food

The bill introduced by Republican Sen. Andrew Jones of Centre would gradually reduce the sales tax on food from 4% to 2% — taking off .5% each year — provided there is more than enough state revenue to offset the loss to the education budget, which relies on sales and income taxes.

As grocery prices soar, push grows to end sales tax on food

Alabama is one of only three states that tax groceries at the same rate as other purchases. But as food prices soar — and as the state sees a record budget surplus — Alabama lawmakers are considering removing, or phasing out, the state's 4% sales tax on food.

Lawmakers wrap up special session on COVID relief funds

Gov. Kay Ivey signed a more than $1 billion plan to spend federal pandemic relief funds after lawmakers approved the package Thursday.

Jefferson County Commission Pursues Healthcare Authority Plan

Jefferson County is moving closer to establishing a healthcare authority to manage indigent healthcare in the county.

Still in Vacation Mode? Tax Holiday Aims to Snap You Out of It

Alabama’s back-to-school sales tax holiday takes place from July 21 - 23. It’s a chance to get folders and highlighters and a lot of clothing tax-free. If it seems awfully early, it’s because it is.

Who Benefits in Repealing Sales Tax on Groceries?

Proponents says exempting groceries from state sales tax would help low-income families and spur the economy. Those predictions could be optimistic.

Changes To How Banks Pay Taxes In Alabama

Birmingham Business Journal reporter Michael Seale discusses two bills in the Alabama legislature that would change how banks pay state taxes.

Alabama, the Second Amendment and Reason

Alabama Media Group columnist John Archibald discusses how Alabama political culture treats guns which he says is not reasonable.

Alabama’s “Back to School” Sales Tax Holiday is this Weekend

Alabama’s annual “back to school” sales tax holiday starts on Friday. That’s when the state waves its 4-percent sales tax on school related items. Many counties and cities drop their sales taxes too. It represents a chance for parents to save but it's also a big weekend stores.

Strong Headwinds Against Wind Energy in Alabama

Drive through the Midwest or Great Plains and you may see expansive wind farms rising from the fields. That sight is not something you see in Alabama. Still there are those who see a place for wind energy in this state and we talk about it in this week’s Magic City Marketplace.