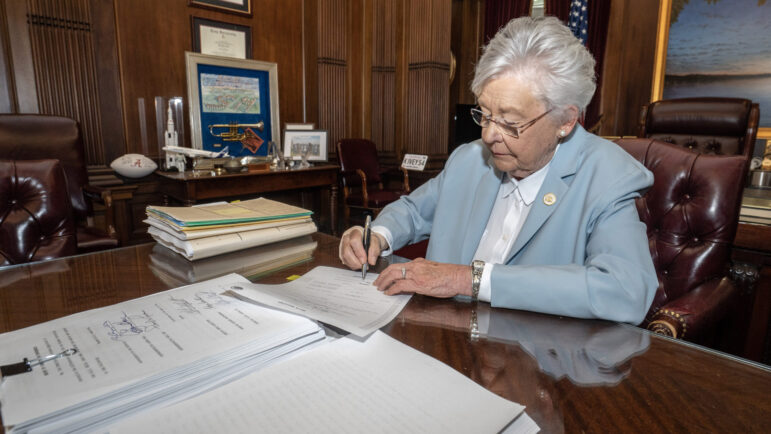

Gov. Kay Ivey signed the state’s education and general fund budgets into law Thursday along with supplemental spending packages, representing nearly $15 billion in total spending. Other major bills are on their way to the governor’s desk as lawmakers gear up for the final day of the regular legislative session on Tuesday.

“Towards the end is when these bills really start moving. Deadlines kind of have that effect on legislative bodies,” said Todd Stacy, host of Capitol Journal on Alabama Public Television.

Stacy discussed that and other action in the legislature this week.

Big bills

The $8.8 billion education budget doesn’t count an additional $2.8 billion in supplemental spending made possible by stronger than expected tax receipts. The general fund budget tops out at $3 billion with about $200 million in supplemental appropriations.

“Some thought maybe she (Ivey) would want to amend the budgets to make them more like the ones she originally proposed, but she also got a lot of what she wanted,” Stacy said.

Arguably the biggest bill to receive final passage is one that would cut the state’s sales tax from groceries, an idea that has previously failed in the legislature multiple times. The bill, approved Thursday, would reduce the existing tax on food from 4% to 3%, starting Sept. 1. It would later drop to 2%, beginning Sept. 1, 2024, if tax collections to the Education Trust Fund are projected to rise at least 3.5% in the upcoming year to offset the loss. If that growth requirement isn’t met, the additional 1% cut would go into effect in the next year revenue projects do meet the threshold.

On Wednesday, the House gave final passage to a bill making changes to the Alabama Accountability Act, which offers scholarships to families with children in so-called failing schools. Parents could use that money for private school tuition or to move to another public school. The changes expand who can participate by raising the income threshold for families to qualify, along with raising the scholarship cap to $10,000 for all grade levels.

The new bill also does away with the term “failing” school, which was defined as the bottom 6% of schools by test scores. Now, schools that receive a “D” or “F” on the state Department of Education’s report card would be deemed “priority” schools.

Exempting overtime pay

On Thursday, the Alabama Senate gave final backing to a compromise bill that would exempt overtime pay from state income taxes. The bill by House Minority Leader Anthony Daniels of Huntsville received bipartisan support, but in the Senate, Sen. Arthur Orr of Decatur, who chairs the Senate education budget committee, expressed concern about the number of tax cuts being passed this session and the potential impact on state revenues. The Senate added an annual cap of $25 million on the amount of the tax cut. The exemption would also end after three years unless renewed by lawmakers.

“The big question is, ‘Will they meet that cap?’” Stacy said. “It’s almost like a pilot program.”

Daniels said the tax cut will help hourly workers and help industries recruit employees to work overtime shifts.

Fossil fuels and firearms boycotts? No state contracts

The House passed a bill on Wednesday that would block state contracts with companies that boycott fossil fuel firms and firearms manufacturers. It now goes to Ivey.

Around the country, some Republicans have taken aim at companies that consider environmental, social and governance matters as part of their investment decisions.

“A lot of it has to do with climate change,” Stacy said.

Critics said the bill represents an intrusion of government into the private sector. Stacy said the measure contains amends that assuaged some concerns from the business community.

“At the end of the day this is something Republicans really wanted to pass and I expect the governor to sign it,” Stacy said.

Lawmakers will return to Montgomery Tuesday for the final day of this year’s regular session.

Other action

Alabama House committee advances bill to overhaul open records law

Alabama approves enhanced penalties for ‘criminal enterprise’