Property Taxes

Don’t Look at Us, Jefferson County Commission Tells People Upset Over Rising Property Taxes

Jefferson County Commission President Jimmie Stephens used the commission’s committee meeting Tuesday as a platform to dispel the misconception that county government is raising property taxes through reappraisals.

Tax Bills Increase for Many in Jefferson County

The former AT&T City Center, a vacant skyscraper in downtown Birmingham, will have a property tax bill about half a million dollars more than last year's. It's one of many properties, including homes, that can expect to pay more in taxes this year.

Voter Guide: Birmingham Voters to Decide School Taxes, Three Council Seats Tuesday

Voters in Birmingham will head to the polls Tuesday to decide the fate of three property taxes for schools and three seats on the City Council.

Jeffco Voters to Decide on Homewood’s Ability to Increase Property Taxes

Homewood doesn't want the state legislature to "micro-manage" its property tax rate. Instead, it wants local control. So a referendum on tomorrow's ballot in Jefferson County will let voters decide whether Homewood can hold a vote to increase property taxes to help fund schools. No such vote is planned at this time.

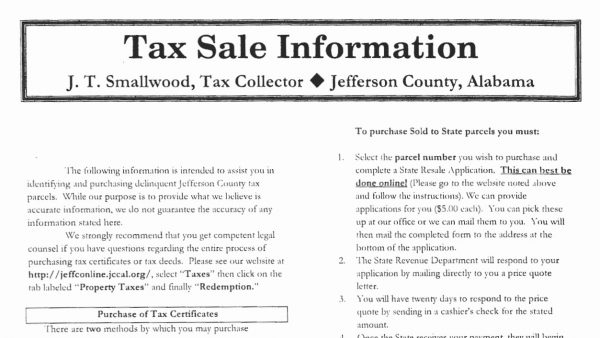

Late Paying Your Property Tax? Investors See An Opportunity

What if you’re late paying your property tax? In Alabama, give it a few months and a lien will probably be placed on your property. But one man’s delinquent property […]

School Funding In Alabama: A View From Sumter County

In more affluent districts, local property tax revenue makes a big difference for schools. But in rural Sumter County, which is mostly farms and timberland, there isn’t much to tax. It’s also hard to raise rates on what is there.