Hours into the federal government shutdown, Julio Fuentes stood steps from the U.S. Capitol to deliver an urgent message about the Hispanic voting bloc that helped the GOP swoop into power last year.

Those votes, he cautioned, are at risk if Congress doesn’t pass a law to preserve low premiums on Affordable Care Act marketplace plans for the roughly 4.7 million people living in his home state of Florida who are enrolled in the coverage.

“Hispanic voters helped return Donald Trump to the White House,” said Fuentes, the CEO of the Florida State Hispanic Chamber of Commerce. “Republican leaders would do right by their constituents to keep coverage affordable, and they will remember that heading into the midterms.”

With less than a month to go before many Americans pick next year’s health insurance plan, Democrats in Congress are holding up government funding to pressure Republicans into extending billions of dollars in federal tax credits that have in recent years dramatically lowered premiums and contributed to record-low rates of uninsured Americans.

Democrats see the high-stakes standoff as a chance to talk about affordable health care as millions of Americans – including those enrolled in coverage through workplace or Medicare – brace for higher costs next year. Party leaders, hoping to win back support from some of the working-class supporters who have drifted away from them, have used the moment to remind voters of the recent cuts Republicans have approved to some health care programs.

Republicans are outwardly exuding confidence that the approach will not find traction, reminding the public that Democrats have forced a shutdown. But a new KFF analysis shows that 80% of all premium tax credits benefited enrollees in states Trump won.

Open enrollment for 2026

The shutdown coincides with open enrollment season, as insurers are preparing to send notices revealing next year’s premium rates for roughly 24 million people enrolled in ACA coverage. The average enrollee is expected to pay more than double if the tax credits are left to expire. Insurers have also said they’ll have to dramatically raise the price of premiums because healthier people will opt out of coverage as it becomes more expensive, leaving a sicker pool of Americans — and less money to cover them.

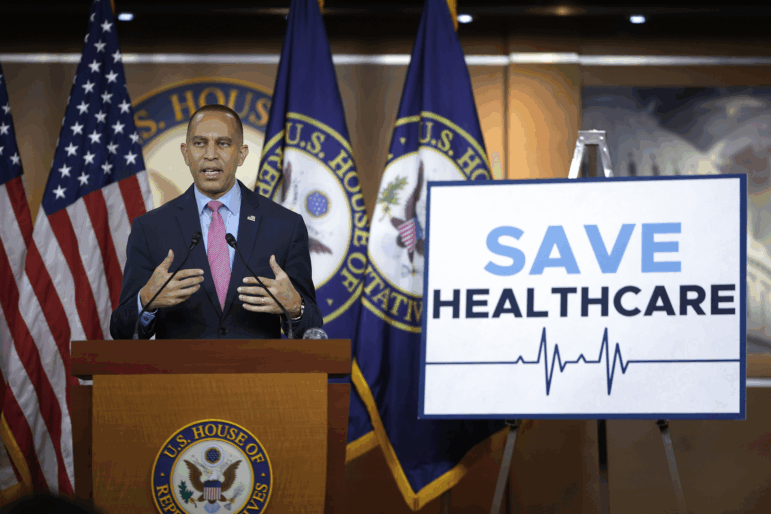

“Over the next few days, what you’re going to see is over 20 million Americans experience dramatically increased healthcare premiums, copays and deductibles because of the Republican unwillingness to extend the Affordable Care Act tax credits,” House Minority Leader Speaker Hakeem Jeffries said on the steps of the Capitol on Thursday.

Open enrollment in most states begins on Nov. 1. Some insurers and exchanges have delayed sending notices detailing premium rates for next year because they are waiting to see what unfolds in Washington. For example, Covered California, the state’s insurance marketplace, is planning to mail out notices to more than a million enrollees later than usual this year, on Oct. 15.

From her home in Richmond, Virginia, 31-year-old Natalie Tyer is anxiously awaiting the arrival of her notice. She checks the state’s marketplace website daily to see if new rates for her insurance plan have posted.

Tyer has relied on marketplace coverage for over a year now while she works part-time for a small, local video production company and pursues a master’s degree to become a school counselor. The tax credits help cover $255 of her monthly premium, bringing it down to $53. Since she’s generally healthy, if the credits expire and her premiums go up significantly, she might drop coverage altogether.

“I very well might have to go without health insurance and may have to rely on hope,” Tyer said.

Democrats’ push to center the shutdown on healthcare affordability, though, runs up against many uncomfortable realities of the federal government’s closure, which will leave millions of federal workers without paychecks, hamper some functions of public health agencies, and threaten food assistance payments for low-income mothers, among other effects.

This isn’t the first shutdown over health care

The ACA, though, has been a political flashpoint since 2010, when Republicans fought against the passage of the landmark health care legislation. A wave of Republican congressional victories soon followed that fight and spurred a government shutdown in 2013, when the GOP tried to gut the program. Party leaders again tried to repeal it in 2017 to follow through on a Trump campaign promise.

The latest clash — over the billions of dollars in tax credits that Democrats issued during the COVID-19 pandemic to boost enrollment in the ACA — has been simmering for months. Democrats, who wrote the original legislation introducing and then extending them, set the enhanced tax credits to expire at the end of this year. Even some Republicans began warning this summer that letting those tax credits lapse could be detrimental, with Republican pollsters Tony Fabrizio and Bob Ward issuing a memo that cautioned an extension of the credits could make a difference in next year’s midterm election.

Extending the ACA tax credits, which have reduced monthly premiums to as little as $0 or $10 for poorer enrollees and capped the amount middle-income Americans paid to just 8.5% of their income, is also a popular move among many Americans.