State’s Historic Tax Credit Expires this Month

From the Lyric Theater in downtown Birmingham to the Howell School in Dothan, a number of renovations have been supported by the state’s historic tax credit. It offered developers financial incentives to take on projects that might have come with big risks. But the bill to renew those tax credits has died this legislative session, and the tax will expire this month.

Opponents to the tax credit say extending it would strain the state budget. The state for the last three years had set aside up to $60 million for different renovation projects. If all the developers who have put in for the tax credit claim their share all at once, it could be a financial burden, Senator Del Marsh is reported to have said. He didn’t return calls for comment.

Former Representative Paul DeMarco worked on the original bill. He doesn’t buy the argument the bill amounts to a government subsidy for developers who should be using their own money for these projects.

“What we have seen is it is private dollars,” DeMarco says. “They’re just seeing a benefit by having this credit, and you’re incentivizing businesses to look at buildings that were sitting empty.”

The bill had strong support in both the House and the Senate. But Senate leaders put the brakes on it. Some have called it welfare for rich people. David Fleming, president and CEO of REV Birmingham says that’s unfair, as both small and large projects have benefited. “Even individual homeowners in historic houses have the opportunity to take advantage of this on a very, very small scale,” Fleming says.

He says every developer takes a risk, especially in areas that have been neglected for decades. And historic buildings come with a lot of construction risk.

“You really don’t know what you’re getting into ’til you get into it,” Fleming says. “And you have a lot of expense that comes up that’s unexpected. Ask anyone who’s ever done a historic building.”

That tax credit helped offset some of those risks. Fleming says the tax credit has also brought more than $400 million of investment across the state. And there was a waiting list for developers planning more projects. He and other supporters of the bill are afraid that now that those credits will expire, those projects might not move forward.

Alabama’s racial, ethnic health disparities are ‘more severe’ than other states, report says

Data from the Commonwealth Fund show that the quality of care people receive and their health outcomes worsened because of the COVID-19 pandemic.

What’s your favorite thing about Alabama?

That's the question we put to those at our recent News and Brews community pop-ups at Hop City and Saturn in Birmingham.

Q&A: A former New Orleans police chief says it’s time the U.S. changes its marijuana policy

Ronal Serpas is one of 32 law enforcement leaders who signed a letter sent to President Biden in support of moving marijuana to a Schedule III drug.

How food stamps could play a key role in fixing Jackson’s broken water system

JXN Water's affordability plan aims to raise much-needed revenue while offering discounts to customers in need, but it is currently tied up in court.

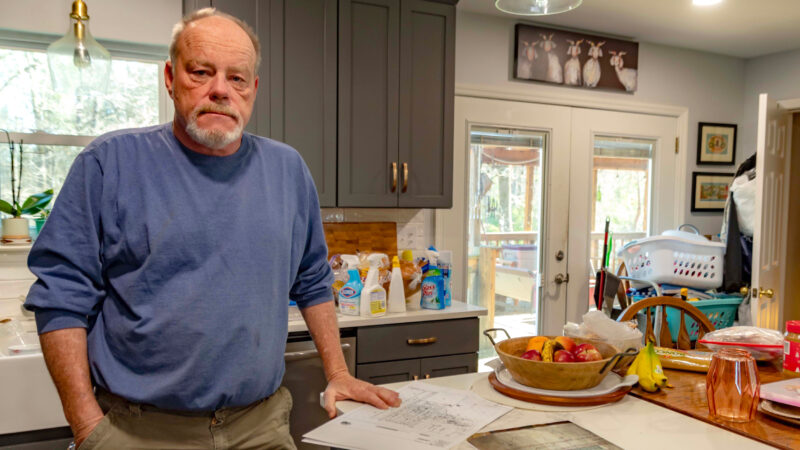

Alabama mine cited for federal safety violations since home explosion led to grandfather’s death, grandson’s injuries

Following a home explosion that killed one and critically injured another, residents want to know more about the mine under their community. So far, their questions have largely gone unanswered.

Crawfish prices are finally dropping, but farmers and fishers are still struggling

Last year’s devastating drought in Louisiana killed off large crops of crawfish, leading to a tough season for farmers, fishers and seafood lovers.