The Fiscal Cliff Deal And Your Taxes

Short Answer: Your Taxes Will Go Up

The new deal to avoid the fiscal cliff means the average Alabamian will pay an additional $579 dollars a year in taxes, but some will pay much more. The tax package passed by Congress yesterday prevents one set of tax increases from hitting most Americans, but it won’t stop them all. A temporary Social Security payroll tax reduction will expire, meaning nearly every wage earner will see taxes go up. The wealthy also face higher income taxes.

The median household income in Alabama is just under $43,000. How the tax increases will affect households at different income levels:

Annual income: $20,000 to $30,000

Average tax increase: $297

Annual income: $30,000 to $40,000

Average tax increase: $445

Annual income: $40,000 to $50,000

Average tax increase: $579

Annual income: $50,000 to $75,000

Average tax increase: $822

Annual income: $75,000 to $100,000

Average tax increase: $1,206

Annual income: $100,000 to $200,000

Average tax increase: $1,784

Annual income: $200,000 to $500,000

Average tax increase: $2,711

Annual income: $500,000 to $1 million

Average tax increase: $14,812

Annual income: More than $1 million

Average tax increase: $170,341

How food stamps could play a key role in fixing Jackson’s broken water system

JXN Water's affordability plan aims to raise much-needed revenue while offering discounts to customers in need, but it is currently tied up in court.

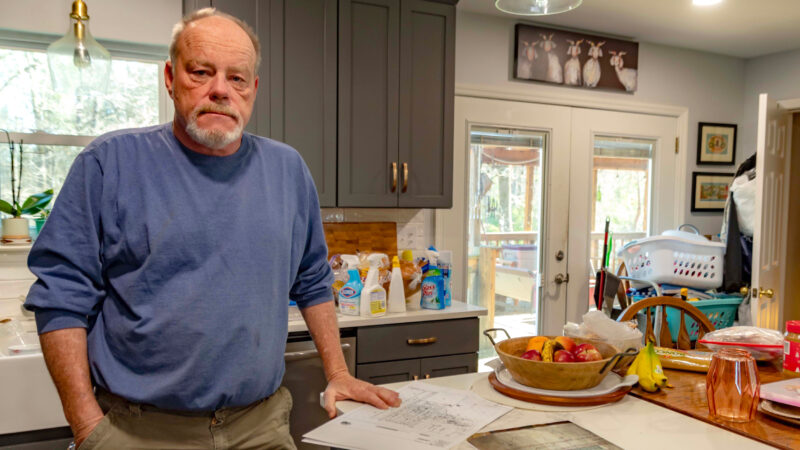

Alabama mine cited for federal safety violations since home explosion led to grandfather’s death, grandson’s injuries

Following a home explosion that killed one and critically injured another, residents want to know more about the mine under their community. So far, their questions have largely gone unanswered.

Crawfish prices are finally dropping, but farmers and fishers are still struggling

Last year’s devastating drought in Louisiana killed off large crops of crawfish, leading to a tough season for farmers, fishers and seafood lovers.

Lawmakers consider medical cannabis revamp

It’s been three years since Alabama lawmakers passed legislation establishing a system to govern medical cannabis in the state, yet not one prescription for the drug has been filled. The rollout has been delayed by lawsuits and conflict over the licensing process.

Man arrested in connection with device that exploded outside Alabama attorney general’s office

Kyle Benjamin Douglas Calvert, 26, of Irondale, Alabama, was arrested Wednesday on charges of malicious use of an explosive and possession of an unregistered destructive device, the U.S. attorney’s office said.

For some Gulf South schools, a March Madness loss can still be a win off the court

Making it into the NCAA Tournament can translate to boosts in student enrollment, athletic involvement, merchandise sales and more for participating schools.