Business Capital, Knowledge Remains Out Of Reach For Many Minority Entrepreneurs

The economic downturn in the wake of the COVID-19 pandemic has shuttered many Birmingham businesses for good. But in the 4th Avenue and Civil Rights commercial districts, none of the 56 Black-owned businesses that work with Urban Impact, an economic development organization for those districts, have gone out of business.

Urban Impact Strategic Growth Manager Elijah Davis said that unusual success “is a true testament to their spirit.”

“We are always resilient and innovative people,” Davis said.

That resilience is needed for entrepreneurs of color. Both in Birmingham and nationwide, Black-owned businesses are less common and less successful, on average, than white-owned businesses.

According to the Federal Reserve Board’s 2017 Survey of Consumer Finances, Black families are about half as likely to own a business as white families.

A summer 2019 study of Birmingham’s business environment, through the city’s Department of Innovation and Economic Opportunity and the Bloomberg Harvard City Leadership Initiative summer fellowship, found that “Black residents make up 74% of Birmingham’s population, but only 50% of businesses are Black-owned.

In contrast, white residents make up 22% of the population, but 47% of businesses are white-owned.”

Data from the Prosperity Now Scorecard, which tracks household economic health and racial inequities, shows that white businesses tend to be more profitable. White-owned businesses had an average of $641,742 in annual receipts in 2012, while minority-owned businesses averaged $190,059.

In Alabama, average receipts for white businesses were $598,063 per year, but minority businesses averaged $127,320.

A 2016 report by the Institute for Policy Studies and CFED, now known as Prosperity Now, said this: “On average, white-owned businesses are worth eight times more than the average Black-owned business.”

The “Living Memory” of Discrimination

Those who have worked in Birmingham’s entrepreneurial community, such as Urban Impact and REV Birmingham, say Black business owners are hindered by lack of access to resources, both financial and informational, that is rooted in history and continues today.

“The legacy of Jim Crow and discrimination is not so much a legacy as it is an active issue,” Davis said.

Discriminatory practices toward Blacks in business are not that far in the country’s past, Davis said. Redlining, the banking practice of denying loans or charging predatory rates based on where applicants live, often was used to discriminate against minority and underserved neighborhoods and wasn’t outlawed until the late 1960s.

“Black Wall Street,” a thriving center of Black economic growth in the Greenwood district of Tulsa, Oklahoma, was violently attacked and burned in what has been termed a “race massacre” in 1921. The mob violence left many formerly affluent Blacks virtually homeless.

Davis said similar business districts in Birmingham, including the 4th Avenue and the Civil Rights districts, were “self-contained” before integration and didn’t have the same access to financial capital as white businesses.

“Legally we were just able to, quite frankly, acquire and have property protected like 50 years ago, in people’s lifetimes. And I think people forget that,” Davis said.

Consequently, those “generations of under-resourcing” are still felt today, he said.

Davis said there is a “living memory” among Black business owners of discriminatory practices. Some don’t even consider bank loans as part of their path to starting a business because they expect that they won’t be given fair treatment.

While redlining and similar policies are no longer legal, lending discrimination still occurs today. A fact sheet from the Association of Black Foundation Executives reports that, while “the average amount offered by the U.S. Small Business Administration for a 7(a) loan is $157,000, the average amount offered to an African American business is only $80,000.”

In 2017, the National Community Reinvestment Coalition found that banks were far more critical in considering small business loans from Black applicants and were less likely to schedule follow-up appointments or offer help completing the loan application. This disparity existed even when Black and white applicants in the study had identical education, age and income.

“We see folks being locked out of the system and being really discouraged,” Davis said.

When the federal Paycheck Protection Program loans were announced as a resource for businesses struggling through the coronavirus pandemic, Davis said many business owners in Urban Impact’s commercial districts didn’t try to apply.

“There were so many folks that did not even examine the process because of previous discouragement, and that’s one of the ugly legacies,” he said.

Becoming “Bank-Worthy”

Another hurdle to securing a business loan is what Kim Carter Evans, TruFund vice president and southeast region managing director, deemed “bank-worthiness.” These are the factors, like credit score and collateral, that banks use to determine loan approvals and interest rates.

Minority-owned and women-owned businesses are more likely to be denied by this process, Evans said. This has led to a disproportionate lack of investment by banks in minority business communities.

“It’s not necessarily by intent,” she said. “But the data absolutely shows that there’s more entrepreneurs of color that are not able to access capital in the traditional means.”

TruFund is a Community Development Financial Institution, which can offer loans and investment for people whose economic situation would cause them to be denied by traditional banks. TruFund works with REV Birmingham and with individual entrepreneurs.

“We can kind of forgive past problem areas, or years where they just didn’t have a good year, and make a loan based on the character of the business and where they are going,” Evans said.

TruFund also has relationships with banks such as Regions and BBVA, she said, to cross-refer clients and provide business training programs.

Similarly, Urban Impact has partnerships with Kiva loans, which are crowdfunded and charge no interest, and a microlending program through IberiaBank as alternative ways to jumpstart new businesses.

Operation Hope, a national nonprofit that offers financial education programs, helps clients understand and control their credit score through its Birmingham programs. “Everything basically is tied to credit,” Operation Hope Regional Vice President Damian Carson said.

Carson said credit scores can influence whether a person is approved for a loan, an apartment, a mortgage or even a job. But many people, especially from impoverished backgrounds, are never taught how the system works.

“If someone can improve their credit by 100 points, that can really change their entire life in terms of wealth building,” he said.

Carson said Operation Hope’s financial coaching services are meant to help put big goals like home ownership or business loans in reach, possibly for the first time in their clients’ lives.

“They can take pride in owning something,” he said. “This is going to create wealth, not only for myself but potentially for generations to come.”

Both Evans and Carson said their organizations’ ultimate goal is to build people up to have both the means and the confidence to walk into a bank in the future, with “head high, eye contact and knowing I’m in position to possibly get approved,” Carson said.

What – and Who – You Know

Access to business knowledge and networking is another area where Black entrepreneurs are often under-resourced.

Ace Graham, the owner of Alchemy clothing store and an entrepreneur for 15 years, said mentorship is needed to start a business, but it’s often missing for Black startups.

“We don’t really have resources, we don’t really have that mentor that you can lean on,” Graham said, particularly for first-generation business owners.

Many of his own learning experiences in business ownership came through his own mistakes, rather than being able to learn from the mistakes of family members or friends in business, he said. Those mistakes cost time and money to fix.

“The information is not being shared. That’s the biggest disparity,” Graham said.

That lack of business acumen can be abused. For example, Graham said a new business owner might not be able to tell if their storefront’s landlord is offering them a fair deal. “A lot of times, their knowledge and wisdom and your lack of (it) creates a disconnect,” he said.

“I think that sometimes minority business owners get exploited for lack of knowledge.”

A deep network of entrepreneurs can also lead to opportunities to expand your business. Graham said some of the traditional networking methods haven’t been fully available to minority business owners.

“It’s all about what room you’re in and what setting you’re in,” Graham said. “I’ve always heard that some of the best deals are done on a golf course,” he added. “If you have no access to the country club, ultimately you have no access to the golf course.”

REV Birmingham Director of Recruitment and Business Growth Taylor Clark Jacobson said the programs at REV fill some of the mentorship and knowledge-sharing roles. They have workshops to develop ideas and business plans to the point of launching a startup, as well as programs on financial empowerment, accessing capital and even finding storefronts to rent.

So far in 2020, REV has worked with more than 800 clients, of which about 61% were minority- or women-owned enterprises.

In Woodlawn, REV has sought out “aspiring entrepreneurs within the neighborhood that have great ideas, that have what we define as ‘hustle,’” Jacobson said. Supporting those businesses as they grow “is the most sustainable and authentic revitalization strategy,” she said, and enables those entrepreneurs to reinvest in their own community in the future.

Similarly, Urban Impact’s BE BHM program is a program specifically for Black entrepreneurs to develop business knowledge and access to networks and resources.

From her position at REV, Jacobson said she sees a “plethora” of educational and financial resources available to give a helping hand. The challenge is getting the word out to those in Birmingham with a big idea, but no connections to the people that can help them get started.

“What we hear from the business owners’ side is many don’t realize what’s available to them,” Evans agreed.

“What I am optimistic about is that there are all these resources, and at the forefront of that conversation is the equity piece,” Jacobson said, adding that there are many local groups working to address barriers to entrepreneurship.

Lifting All Boats

Part of a business’ success is based in the neighborhood around it. Darryl Washington, Urban Impact chief operations officer and director of programs, said the organization focuses on the “built environment” of its commercial districts alongside individual enterprises.

Urban Impact meets with property owners and developers regularly to find the best uses for commercial properties to increase value and entice businesses. Washington said the number of Black commercial property owners in the 4th Avenue and Civil Rights districts is unique in the city and “a very key dynamic to how this district has survived.”

“The commercial district in any community is really the heart of the community,” Washington said.

Collaboration – among entrepreneurs, developers, property owners and local government – is the “true backbone for growth from a commercial district standpoint,” he said.

Urban planning and zoning in the past, like redlining, has been “a tool to basically destroy the wealth of Black folks,” Davis said. So Urban Impact stays closely involved in the city’s urban planning process to ensure a voice for their commercial districts, including in development of Birmingham’s city center and the upcoming CityWalk project.

There are 99 neighborhoods in Birmingham, but only a few organizations focused on the development of entire commercial districts. Washington said he would like to see a “network of thriving commercial districts” across the city to improve employment options, entrepreneurship and tax dollars reinvested in the community.

“I think you only get there by having some feet on the streets, some grunt workers” like Urban Impact, he said.

Creating a “Just Economy”

The work of groups like REV, Operation Hope, Urban Impact and TruFund can help individual entrepreneurs, or individual commercial districts, become more economically successful. One of Urban Impact’s initiatives was to create a directory, blkLSTed, for consumers who want to spend their money with Black-owned businesses and nonprofits.

However, Davis said this is only one piece of the larger conversation of racial disparities.

“Black entrepreneurship is not the silver bullet to solve racial injustice. We have a larger problem of racial injustice in the country and it’s a multi-faceted, multi-sector approach,” he said.

Davis said “full-throated,” longitudinal efforts are needed to address the inequalities minorities face in every aspect of life. “The whole picture is that justice for women, justice for Black folks, justice for any marginalized and oppressed group is really the core of the problem,” he said.

He said Birmingham is beginning to understand the idea of creating a “just economy,” but there’s work to be done.

“That is still going to be the defining challenge of the city in the next 10 years,” Davis said. “It will not get better if we don’t just call it what it is and deal with it.”

Why haven’t Kansas and Alabama — among other holdouts — expanded access to Medicaid?

Only 10 states have not joined the federal program that expands Medicaid to people who are still in the "coverage gap" for health care

Once praised, settlement to help sickened BP oil spill workers leaves most with nearly nothing

Thousands of ordinary people who helped clean up after the 2010 BP oil spill in the Gulf of Mexico say they got sick. A court settlement was supposed to help compensate them, but it hasn’t turned out as expected.

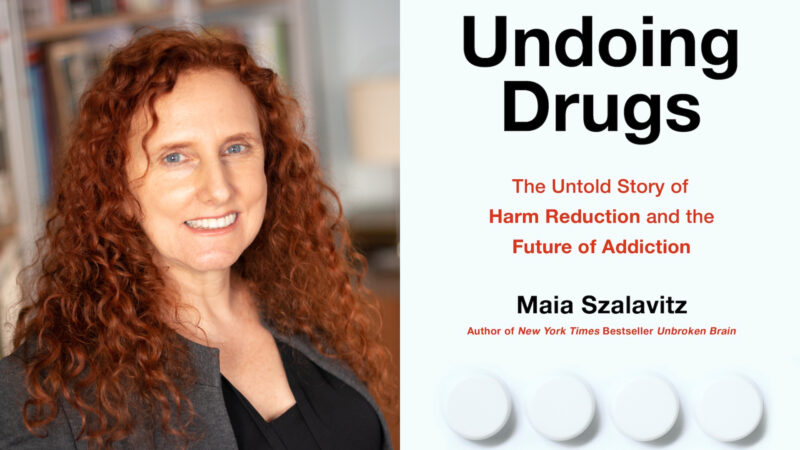

Q&A: How harm reduction can help mitigate the opioid crisis

Maia Szalavitz discusses harm reduction's effectiveness against drug addiction, how punitive policies can hurt people who need pain medication and more.

The Gulf States Newsroom is hiring a Community Engagement Producer

The Gulf States Newsroom is seeking a curious, creative and collaborative professional to work with our regional team to build up engaged journalism efforts.

Gambling bills face uncertain future in the Alabama legislature

This year looked to be different for lottery and gambling legislation, which has fallen short for years in the Alabama legislature. But this week, with only a handful of meeting days left, competing House and Senate proposals were sent to a conference committee to work out differences.

Alabama’s racial, ethnic health disparities are ‘more severe’ than other states, report says

Data from the Commonwealth Fund show that the quality of care people receive and their health outcomes worsened because of the COVID-19 pandemic.