State’s Historic Tax Credit Expires this Month

From the Lyric Theater in downtown Birmingham to the Howell School in Dothan, a number of renovations have been supported by the state’s historic tax credit. It offered developers financial incentives to take on projects that might have come with big risks. But the bill to renew those tax credits has died this legislative session, and the tax will expire this month.

Opponents to the tax credit say extending it would strain the state budget. The state for the last three years had set aside up to $60 million for different renovation projects. If all the developers who have put in for the tax credit claim their share all at once, it could be a financial burden, Senator Del Marsh is reported to have said. He didn’t return calls for comment.

Former Representative Paul DeMarco worked on the original bill. He doesn’t buy the argument the bill amounts to a government subsidy for developers who should be using their own money for these projects.

“What we have seen is it is private dollars,” DeMarco says. “They’re just seeing a benefit by having this credit, and you’re incentivizing businesses to look at buildings that were sitting empty.”

The bill had strong support in both the House and the Senate. But Senate leaders put the brakes on it. Some have called it welfare for rich people. David Fleming, president and CEO of REV Birmingham says that’s unfair, as both small and large projects have benefited. “Even individual homeowners in historic houses have the opportunity to take advantage of this on a very, very small scale,” Fleming says.

He says every developer takes a risk, especially in areas that have been neglected for decades. And historic buildings come with a lot of construction risk.

“You really don’t know what you’re getting into ’til you get into it,” Fleming says. “And you have a lot of expense that comes up that’s unexpected. Ask anyone who’s ever done a historic building.”

That tax credit helped offset some of those risks. Fleming says the tax credit has also brought more than $400 million of investment across the state. And there was a waiting list for developers planning more projects. He and other supporters of the bill are afraid that now that those credits will expire, those projects might not move forward.

Birmingham is 3rd worst in the Southeast for ozone pollution, new report says

The American Lung Association's "State of the Air" report shows some metro areas in the Gulf States continue to have poor air quality.

Why haven’t Kansas and Alabama — among other holdouts — expanded access to Medicaid?

Only 10 states have not joined the federal program that expands Medicaid to people who are still in the "coverage gap" for health care

Once praised, settlement to help sickened BP oil spill workers leaves most with nearly nothing

Thousands of ordinary people who helped clean up after the 2010 BP oil spill in the Gulf of Mexico say they got sick. A court settlement was supposed to help compensate them, but it hasn’t turned out as expected.

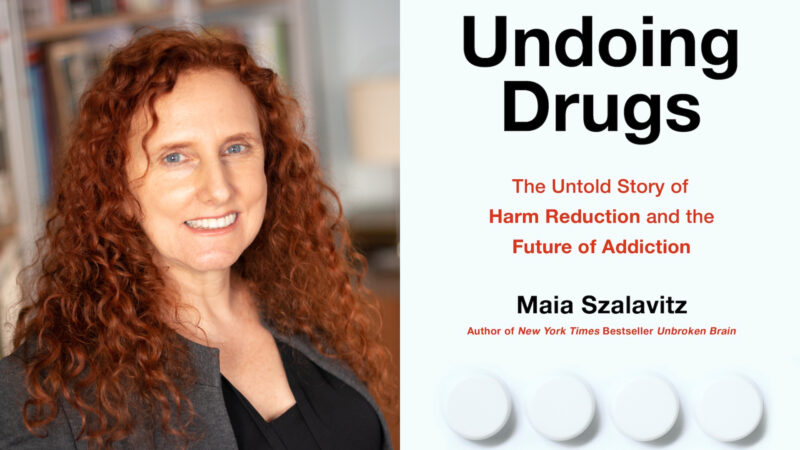

Q&A: How harm reduction can help mitigate the opioid crisis

Maia Szalavitz discusses harm reduction's effectiveness against drug addiction, how punitive policies can hurt people who need pain medication and more.

The Gulf States Newsroom is hiring a Community Engagement Producer

The Gulf States Newsroom is seeking a curious, creative and collaborative professional to work with our regional team to build up engaged journalism efforts.

Gambling bills face uncertain future in the Alabama legislature

This year looked to be different for lottery and gambling legislation, which has fallen short for years in the Alabama legislature. But this week, with only a handful of meeting days left, competing House and Senate proposals were sent to a conference committee to work out differences.